GLOBAL FERTILIZER MARKET - KEY HIGHLIGHTS

Global Urea market

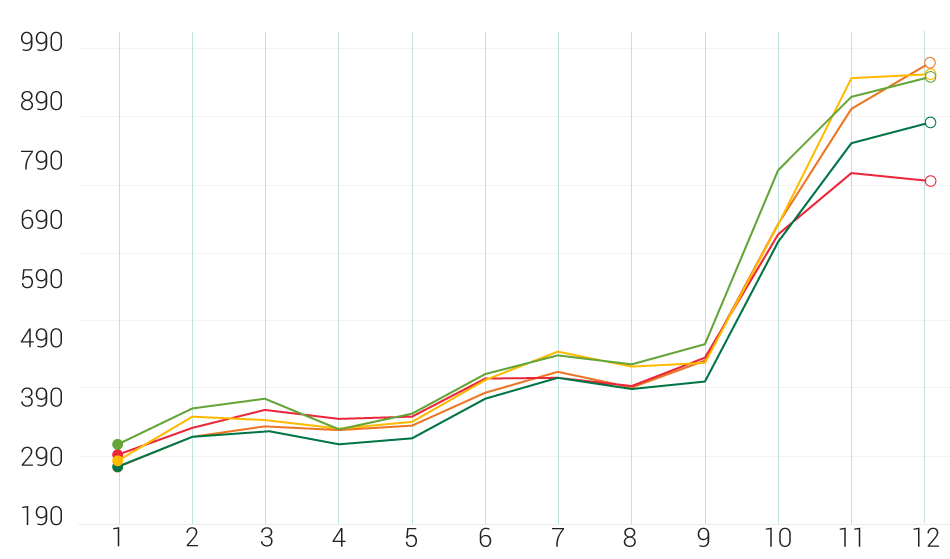

- The Urea supply in 2021 was likely to be tightened as of 2020 in some regions such as China, Southeast Asia, Europe and Baltic states due to negative impacts of Covid-19 pandemic plus export restrictions of some countries and “export quota allocation” mechanism.

- Supply, transportation and delivery of Urea continued facing difficulties due to supply and transportation chain disruptions in 2020 which had impacts on flow of goods in some countries. 2021 saw port congestions with goods and containers stuck at major seaports in USA, China, Brazil, Argentina, Europe.

- Governments have been taking important steps to maintain stable domestic supplies instead of boosting export as previous time. Countries like Russia, Egypt, Turkey have proactively posed the same measures, China and Russia maintained strict control mechanisms on fertilizer export till end of June 2022 and May 2022 respectively.

- Highly maintained level of key agricultural products in 2021 has ensured fertilizer needs for farmers, especially in Latin American region (corn, soybean in Brazil, Argentina), Southeast Asia (raw palm oil in Indonesia, Malaysia).

- The higher demand of hoarding materials for NPK production in some countries has accelerated demand of Urea, especially in countries like China, Thailand, India, Pakistan, Brazil, Indonesia, Malaysia.

- Drastic price increases of Urea and difficulties during Covid-19 pandemic have made Urea “more scarce” than before.

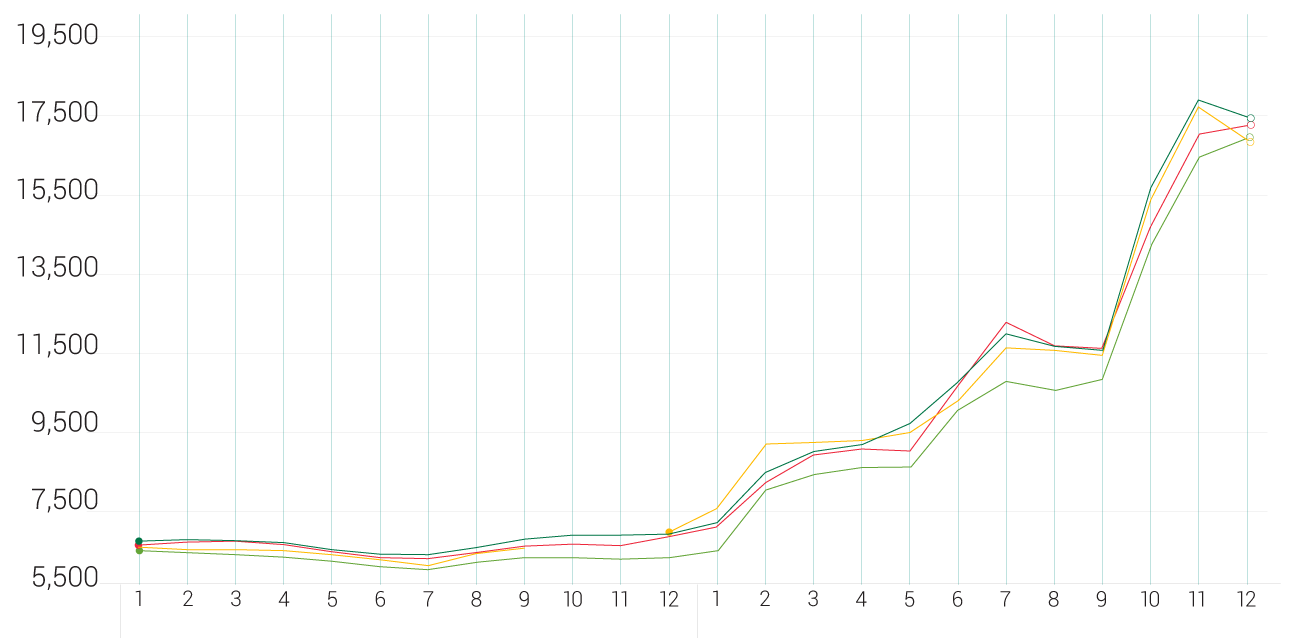

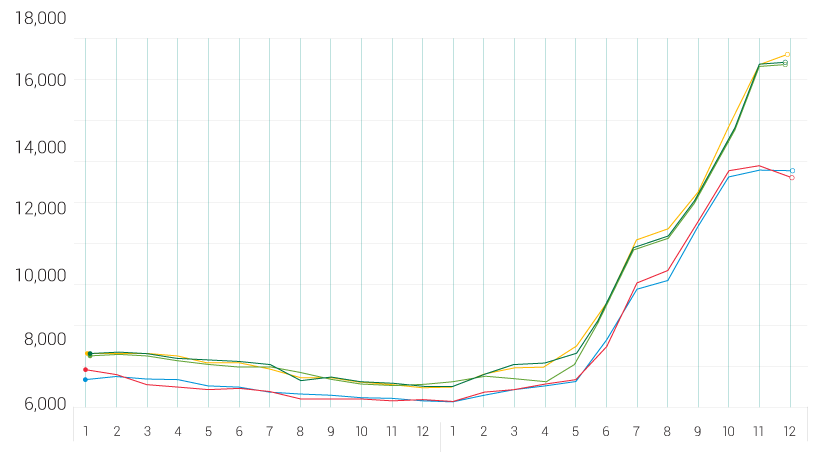

Global monthly average Urea price development in 2021

Unit: US$/ton

2021

(Source: Argus, Fertecon)

Time: The first quarter of 2022

-

Yuzhnyy Prilled Urea

-

Granular Urea in Middle East

-

Nola granular Urea

-

Granular Urea in Egypt

-

Granular Urea in Southeast Asia

Global potassium market

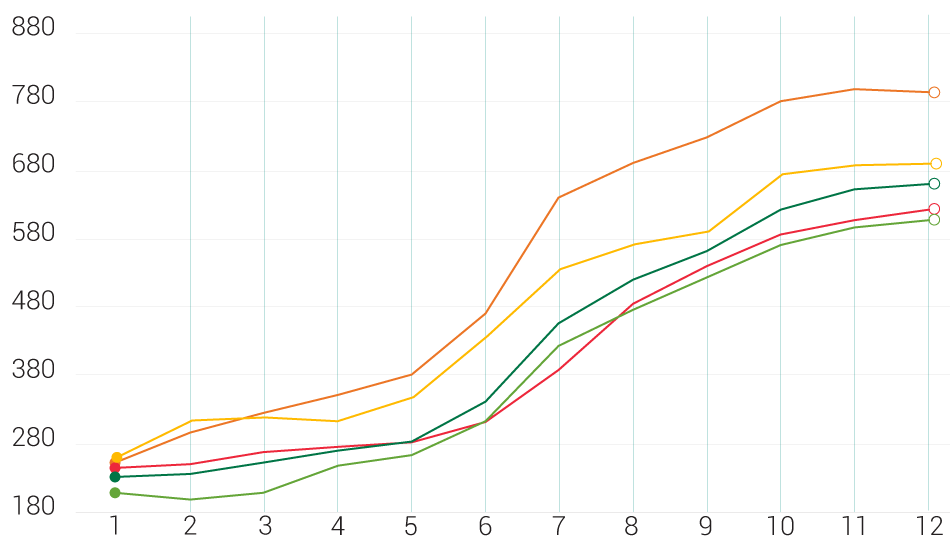

- The higher demand of hoarding materials for NPK production in some countries has pushed demand of potassium to a sudden rise in some time (especially in China, India, Southeast Asian countries).

- Alliance/Agreements between large potassium manufacturing corporations (Canpotex, ICL, BPC, APC and Uralkali, etc.) have caused rising price of potassium as well as their proactive actions of tightening supply. Floor prices remained at US$ 220/ton CFR in India and US$ 230/ton CFR in China in 2020 but disappeared in 2021; countries known as main markets such as India, Brazil, etc. applied quick purchase orders to avoid higher prices due to active import price increases of potassium in some countries to purchase more products to timely meet domestic demand in high seasons, especially in largest agricultural producing countries such as USA, Brazil, Argentina.

- The fact that USA, EU imposed economic sanctions against Belarusian regime has dropped the supply of potassium in the global trade balance. As the world No.2 supplier of potassium, after Canada, with economic sanctions imposed by USA, has sharply dropped the supply of potassium of Belarus in the market, contributed to higher prices of potassium because Belarus’ traditional import partners started to seek new market.

- Price of global potassium increased sharply in 2021, at some time much higher than price of global Urea.

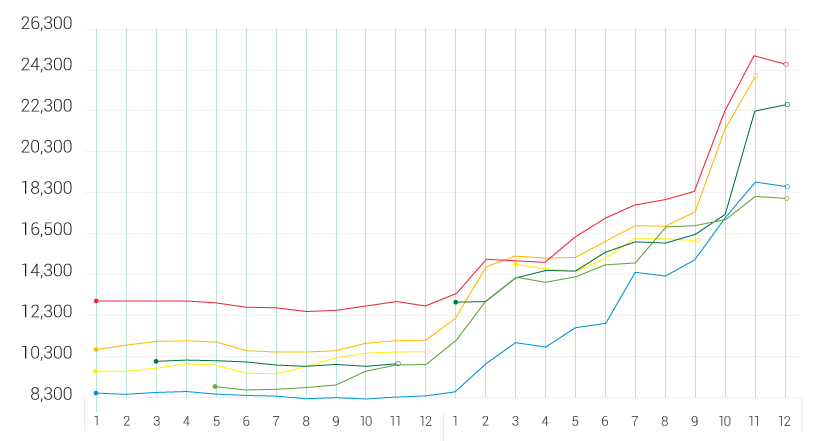

Global monthly average potassium price development in 2021

Unit: US$/ton

2021

(Source: Argus)

Time: The first quarter of 2022

-

gMOP Brazil C&F

-

sMOP SE Asia C&F

-

gMOP Nola FOB (st)

-

sMOP Baltic/Black Sea - FOB

-

sMOP Israel - FBO

Global DAP market

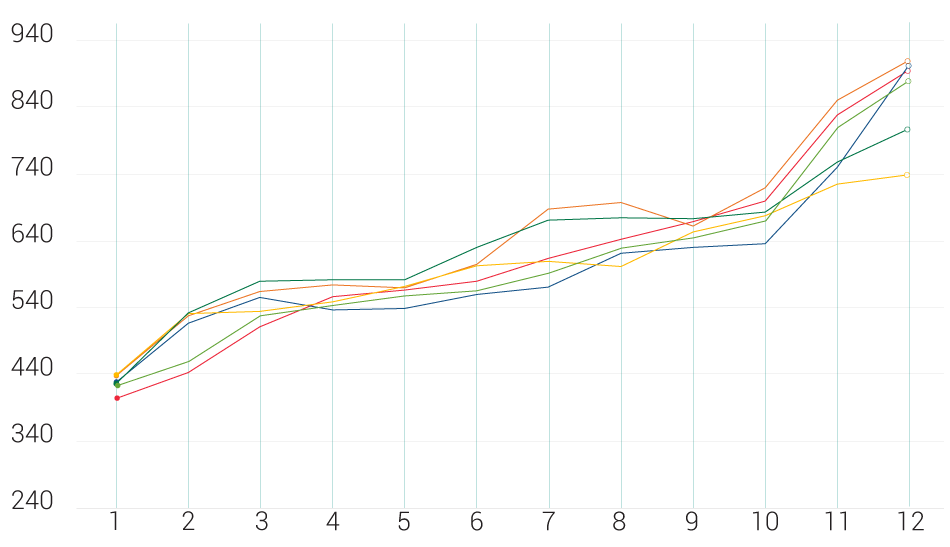

Apart from common factors as above mentioned Urea and potassium markets, DAP market was also impacted by other factors as follows:

- The higher demand of hoarding materials for DAP production in some countries has pushed demand of DAP to a sudden rise in some time (especially in China, India, Pakistan, Indonesia, Malaysia).

- Production capacity of DAP in China, India declined due to domestic production cost higher than foreign countries. It caused high demand of DAP import to deal with economic efficiency.

- High costs of NH3 and sulfur (approximately 30% to 50%/quarter) have pushed the production cost of DAP higher.

- Countries with high consumption demand of DAP have pushed price of DAP import higher to purchase more products (USA, Brazil, etc.), this has by chance pushed the price of DAP more higher in other markets.

- China’s suspension of DAP exports to other countries, except for traditional markets such as South Asia and Southeast Asia, has caused a sharp decline in export volume.

- DAP price showed an upward trend in global scale

Global monthly average DAP price development in 2021

Unit: US$/ton

2021

(Source: Argus)

Time: The first quarter of 2022

-

DAP Tampa FOB

-

DAP Morocco FOB

-

DAP Nola FOB (st)

-

DAP Saudi Arabia FOE

-

DAP China FOB

-

DAP India C&F

VIETNAM FERTILIZER MARKET - KEY HIGHLIGHTS

Domestic Urea market

- Demand of farmers remained stable but demand for Urea fertilizer from NPK plants increased sharply (manufacturing and hoarding)

- Demand from distribution system increased, even speculation and hoarding of goods occurred in some localities in certain times.

- Urea price showed an upward trend as of 2020 due to high price of global Urea fertilizers.

Urea price development in wholesale market in HCMC in 2021

Unit: VND/kg

2020

2021

(Source: Agrimonitor)

-

Phu My Urea

-

Ca Mau Urea

-

Malaysian Granular Urea

-

Ninh Binh Urea

- Psychology of “buying at any cost” occurred in the context of high demand in both domestic and global markets.

- Domestic inventories fell sharply in the first and second quarter of 2021 due to exports greater than imports or domestic low season.

- Covid-19 pandemic has caused disruptions in supply chain, transportation, delivery, loading and uploading (domestically, import and export)

- Urea Import-export in 2021:

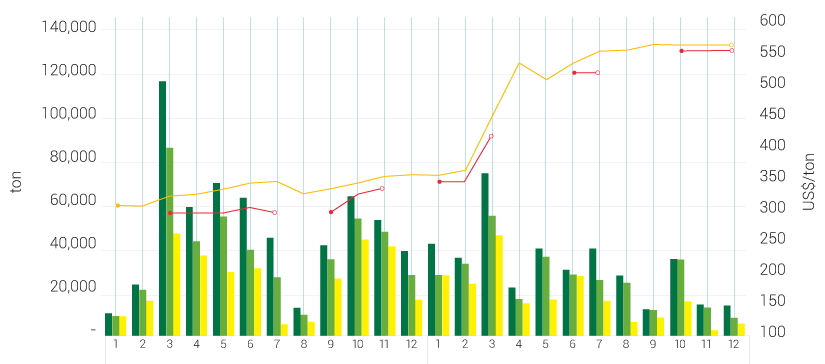

Vietnam Urea import & export Diagram in 2021

2020

2021

(Source: General Department of Customs and Agrimonitor)

Time: The first quarter of 2022

-

Total volume of imports, tons

-

Imported from China, tons

-

Road imports, tons

-

Import price of DAP 64% green by road, US$/tons DAP

Domestic DAP market

- Demands of both farmers and NPK plants improved in the fourth quarter of 2021.

- Domestic DAP price increased along with global price surge but at slower speed.

DAP price development in wholesale market in HCMC in 2021

Unit: VND/kg

2020

2021

(Source: Agrimonitor)

Time: The first quarter of 2022

-

Van Thien Hoa DAP 64% green, VND/kg

-

Dinh Vu DAP Green/Black, VND/kg

-

Egyptian DAP 64% yellow, VND/kg

-

Tuong Phong DAP 64% Green, VND/kg

-

Korean DAP 64% Black, VND/kg

-

Russian DAP Black, VND/kg

- Domestic supply declined due to disruptions in material supply, especially Apatite Ore supply for Dinh Vu and Lao Cai factories at certain times.

- The acute shortage of DAP fertilizer can cause impacts on NPK production factories.

- DAP import & export in 2021:

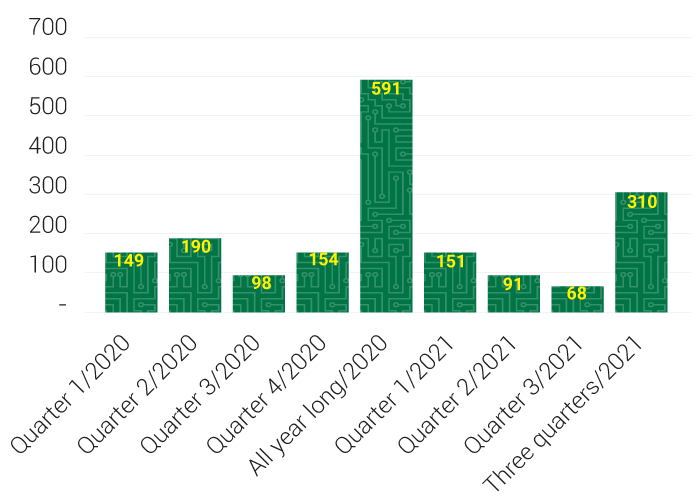

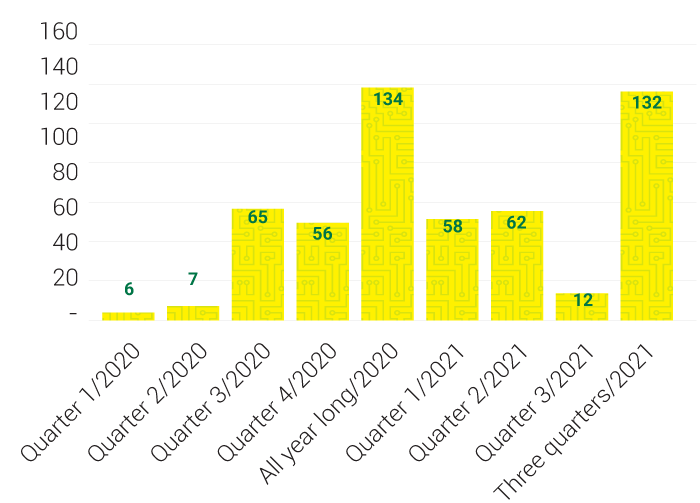

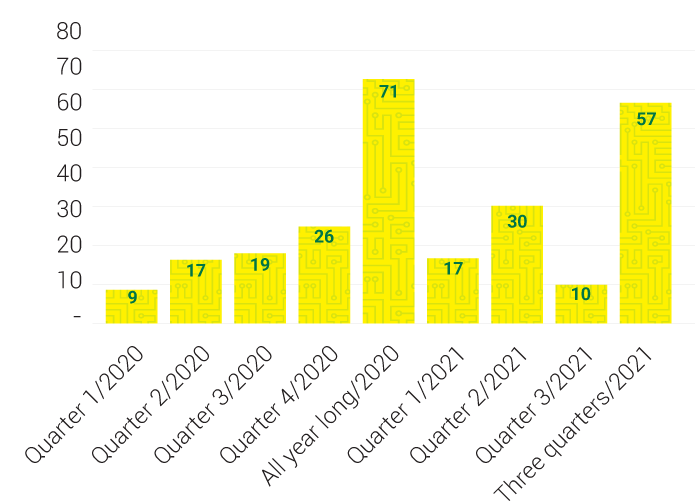

DAP imports (thousand tons)

DAP exports (thousand tons)

Time: The fourth quarter of 2021

(Source: General Department of Customs and Agrimonitor)

Domestic potassium market

- Potassium demand of farmers and NPK plants improved as of 2020. This is shown through annual potassium import data of Vietnam which always remains at over 1 million tons/year.

- Price of domestic potassium increased sharply as of 2020 due to high import prices and demand from NPK plants pushing consumer sentiment of buying and storing higher than previous years.

Potassium price development in wholesale market in HCMC in 2021

Unit: VND/kg

2020

2021

(Source: Agrimonitor)

Time: The first quarter of 2022

-

Israel Potassium (powder, pink/red)

-

Belarus Potassium (piece)

-

Russia Potassium (powder, pink/red)

-

Canada Potassium (piece)

-

Israel Potassium (piece)

- Export of potassium increased in the fourth quarter of 2021 due to long-term signed import agreements by distributors. Besides, in order to have good proactive planning on input materials, NPK plants may proactively import a large amount of potassium in the coming months to minimize risks due to price fluctuation and supply disruptions.

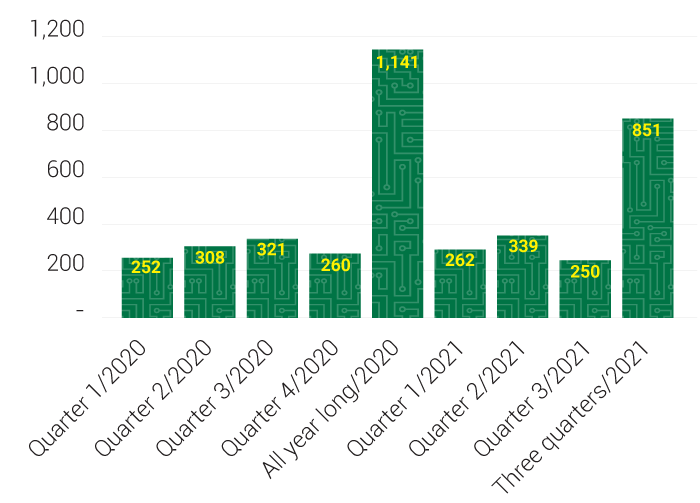

- Potassium import & exports in 2021:

Potassium imports (thousand tons)

Potassium exports (thousand tons)

Time: The fourth quarter of 2021

(Source: General Department of Customs and Agrimonitor)