EB’S ASSESSMENT ON PRODUCTION AND BUSINESS PERFORMANCE

ASSESSMENT ON THE COMPANY’S POSITION/COMPARISON OF PERFORMANCE WITH COMPANIES IN THE SAME INDUSTRY

TOTAL CONSUMPTION VOLUME

thousand tons.

Ca Mau Fertilizer is one of the leading fertilizer enterprises in Vietnam, currently leading the domestic market in terms of output and market share, especially in the Mekong Delta, with impressive revenue and profit growth in recent years. In 2024, total consumption output reached 1,325.3 thousand tons of various products, an increase of 5% compared to 2023, and export volume reached 319 thousand tons, accounting for 24% of total consumption output, significantly contributing to completion of the Company’s business plan.

In 2024, Ca Mau Fertilizer held about 10.62% of market share in Vietnam. Given the fierce competition in domestic market, especially with the cheap fertilizers imported from different sources, thanks to creative communication strategies, the fertilizer products under Ca Mau Fertilizer brand have received the response of a large number of customers and farmers.

PARTICULARLY, FOR THE FIRST TIME, CA MAU FERTILIZER HAS ENTERED AUSTRALIA AND NEW ZEALAND, TWO OF THE WORLD’S MOST DEMANDING FERTILIZER MARKETS.

For consumption market:PVCFC continues to maintain strategic target markets such as Mekong Delta, Southeast, Central Highlands, and Cambodia and proactively expands exploitation and development in the Central and Northern regions. Continuing to develop and expand international business, PVCFC has exported to nearly 20 countries, in which, for the first time, Ca Mau Fertilizer has entered Australia and New Zealand, two of the most demanding fertilizer markets in the world. For international business cooperation, PVCFC has cooperated with Samsung to distribute fertilizers globally. Accordingly, Samsung will export products manufactured by PVCFC such as NPK, Urea granules, etc. to the world market, and PVCFC will import Urea, DAP, MOP, and Amsul from Samsung as raw materials for production and trade. In addition, to ensure the supply of raw materials at high quality and competitive price, PVCFC has signed an exclusive distribution agreement for yellow/natural DAP 64 with Yuntianhua Group – one of the world’s largest chemical corporations

LEVEL 1 DISTRIBUTION SYSTEM WITH MORE THAN

agents and hundreds of Level 2 agents across the country.

For distribution system:PVCFC currently owns a large distribution system throughout Vietnam and Cambodia. Distribution system with more than 90 Level 1 agents and hundreds of Level 2 agents is widely deployed in all regions. PVCFC continues to expand B2B distribution channels, providing solutions for farms and NPK production enterprises, initially cooperating with 03 major customers i.e. Thanh Thanh Cong, ThaAgri, and Vinacomin. In addition, with the expansion of Urban Agriculture Stores, PVCFC researches and develops an online sales channel to provide nutritional solutions for plants, aiming to provide high-tech agricultural solutions in domestic market.

ANALYSIS OF THE COMPANY’S PERFORMANCE COMPARED TO THE 2023 BUSINESS PLAN AND RESULTS

In 2024, PVCFC successfully completed the tasks assigned by the GMS with revenue and profit as follows:

DETAILED ASSESSMENT ON KEY TASKS

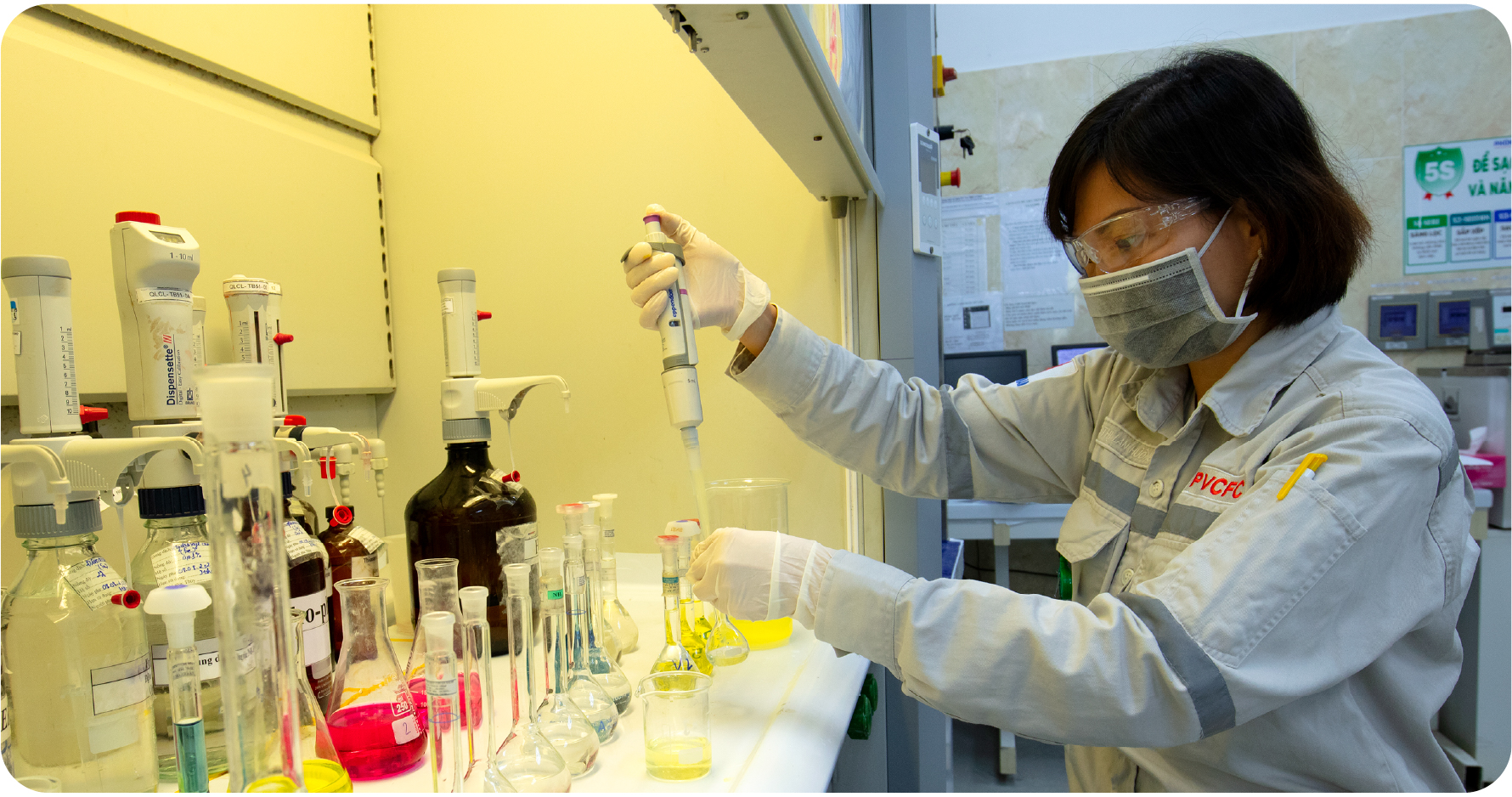

PRODUCTION ACTIVITIES

In 2024, the Plant operated safely and stably with an average capacity of 115%, higher than plan and the same period in 2023, although the system has been shutdown 33 times (435.6 hours), an increase of 111% compared to 2023 (206.1 hours). Overall maintenance has been done for 3,202 items with the participation of more than 1,700 people, resuming production 2.5 days prior to the schedule and saving costs by 18% of the estimate. As of December 25, 2024, PVCFC reached 11 million tons of converted urea after nearly 13 years of operation and is reach 956 thousand tons by the end of 2024, hitting the record of converted urea since the Plant was put into operation. NPK workshop has operated stably to meet the market demand with an output of more than 207 thousand tons, reaching 110% of the plan, equal to 137% of the same period in 2023. The product is highly appreciated in quality and positively received by farmers.

Optimization is always a top priority of PVCFC, playing an important role in improving capacity, increasing output, optimizing raw materials and fuels, and raising product quality. The Company has implemented many innovation projects to reduce consumption, optimize equipment and machinery productivity, and increase capacity. In 2024, the Company completed and put into operation 10 improvements, deployed food CO2 production project, and completed approval of FS (Feasibility Study) for industrial gas production project. In addition, the Company is selecting of consultant for FS of the project to increase the capacity to 125%.

With the right orientation and the persistency in pursuing goals, from 2021 to now, the Plant’s operating capacity has increased from 109% to 115% compared to the design; energy consumption decreased from 22,215 GJ/ton of urea bag in 2021 to 21.78 GJ/ton of urea bag in 2024; and consumption rate reduced by 4.32% as per 22,763 GJ/ton of urea bag in 2024.

MANAGEMENT IN BUSINESS - MARKETING COMMUNICATION

TOTAL CONSUMPTION OUTPUT

million tons

PRODUCT GROWTH 5% COMPARED TO 2023

In 2024, export volume reached 319 thousand tons, accounting for 24% of total consumption output, significantly contributing to the completion of business plan. PVCFC is the first Vietnam’s enterprise to obtain Certificate of Bulk Export to Australia, marking its presence in nearly 20 countries and territories worldwide. PVCFC continues to be a long-term exclusive partner with Yuntianhua Group – one of the world’s largest chemical corporations to distribute high-quality DAP in Vietnam. In particular, Samsung C&T becomes a strategic partner to distribute Ca Mau Fertilizer in the world’s market, demonstrating PVCFC’s position and prestige in both local and global fertilizer markets

PVCFC’S NPK FERTILIZER HOLDS NUMBER 2 POSITION IN DOMESTIC MARKET WITH

thousand tons/year

AFTER MORE THAN 3 YEARS OF LAUNCHING

The NPK market has a large surplus supply and is witnessing not only a fierce competition among domestic manufacturers but also a great pressure from cheap NPK imported from Russia and Korea. However, the creative promotion and communication strategies with brand development programs named “Golden season of great victory”, “Golden secret”, “Golden season of prosperity” etc. along with product trial activities, factory tours, and practical sales promotion targeting distribution channels and farmer customers have contributed significantly to bringing NPK products of Ca Mau Fertilizer brand to the 2nd position in the domestic market, reaching a consumption output of 175.8 thousand tons/year after over 3 years of launching. The domestic market share of Ca Mau Fertilizer also reached about 10.62% by the end of 2024.

PVCFC enhances to use and exploit digital technology platforms in business operations such as ERP, Eoffice, DMS, CRM, App 2Nong, RFID, Data Lake and BI. The Company officially launched AI for pest diagnosis on December 17, 2024 and has just opened its first Urban Agriculture Supermarket. These have shown PVCFC’s constantly diversifying products, perfecting supply chain and applying agricultural service solutions.

INVESTMENT & CONSTRUCTION

Apart from expanding market share, international business, technology application, shift of business platform in line with new development trend, PVCFC pursues sustainable development and investment trends. We have invested in constructing infrastructures for production, building wholesale port and terminal system; constructing Ca Mau Fertilizer Plant in Binh Dinh Province; investing in a new office in HCMC in line with development scale in the future; acquiring Korea-Vietnam Fertilizer Co., Ltd (KVF) to produce NPK Korea- Vietnam fertilizer. Other items include procurement of equipment for management, cyber security is implemented in accordance with the plan, ensuring continuous, safe operation; innovating and digitizing management related activities, improving labor productivity.

OTHER MANAGEMENT ACTIVITIES

PVCFC has put into use objective management module and Procurement management module under the risk management software have been put into use, increasing total number of modules integrated on Eoffice up to 21, synchronizing IT system and improving management efficiency. The Company has also deployed Data Platform go-live, including Data Warehouse on Microsoft Azure, OSISoft PI system, OKR & KPI kick-off as well as implementing the projects of preparing governance reports.

PVCFC is one of the pioneering enterprises in approaching, researching and integrating ESG (Environmental, Social, and Governance) into the development strategy. Streamlining and standardizing internal documentary system, gradually digitizing regulatory processes, building a decentralization matrix (RACI) between the BOD and the EB. On November 16, 2024, PVCFC was honored to be named in Top 10 companies with Best Corporate Governance 2024; the companies with Corporate Governance Beyond Compliance, the companies with Most Reliable Sustainability Report. These awards have further affirmed and motivated the Management and the employees of PVCFC to focus all efforts to develop the Company’s solidarity and successfully implement its mission and orientation.

Renovation and creativity in researching and improving science and technology: 03 Vietnam Science and Technology Innovation Awards (Vifotec), 10 innovations applied, and 57 initiatives recognized in management and business activities.

In 2024, PVCFC planned to build a corporate culture that both inherits and blends with PVN culture and has its own unique, creative and innovative identity to help create clear cultural values. Accordingly, the Company has continued to promote corporate culture communication where 100% of employees are trained in Code of Conduct (COC) through Elearning and Workshop “PVCFC Culture - From understanding to action commitment”. The Company also organizes cultural training combined with teambuilding through the “Value Creation” series. Thanks to that, each employee is nurtured physical, mental, and emotional well-beings to enhance their spirit of sharing and helping. PVCFC’s employees have actively participated in the contest “Petrovietnam Pride” and achieved proud prizes, including 01 second prize for the collective with the most number of videos and 01 third prize for individuals.

PVCFC is honored by VCCI in Top 10 “Outstanding Enterprises for Employees” in 2024, for 5 consecutive years. PVCFC is also one of 10 enterprises with Certificate of Merit for good implementation of labor laws and good care of material and spiritual life of employees in 2024.

Continuous restructuring is essential for enterprises to survive and develop in a volatile business environment. Restructuring helps PVCFC find flexible solutions to adapt to market changes and technological changes, and respond to risks to increase operational efficiency, maintain competitive advantages, and create a foundation for innovation and sustainable development. In 2024, PVCFC continued to restructure its strategy, operations, organization and resources, to be specific:

Reviewing the implementation of 5-year plan for the period 2021 - 2025 and proposing solutions to reach the highest goals for the 5-year period 2021 - 2025. Researching orientation, analyzing opportunities and challenges, shifting trends to set goals and targets for the period 2026 - 2030 to report to shareholders. Researching product diversification, expanding to foliar spray, water-soluble fertilizers and solutions for urban agriculture.

In operation, the Company continuously reviews, adjusts and completes the system of procedures and regulations (standardizing internal documents, amending, supplementing and issuing 17 regulations and 01 process), applies technology and digitalization to all activities from input to output (such as TPM, CMMS, MMS, PI systems of Osisoft; ERP, Eoffice, Power BI; DMS, CRM, App 2Nong, “Anh Hai Ca Mau” AI, AI for pest diagnosis etc.). In 2025, PVCFC will construct a smart manufacturing factory.

In addition, PVCFC has restructured organization, streamlined management apparatus, decentralized power, and established new departments to optimize operations and conform to governance trends, including establishing a representative office in Ho Chi Minh City, updating Korea-Vietnam Fertilizer Co., Ltd. as a subsidiary of which 100% of charter capital is owned by PVCFC, establishing BOD Office, establishing New Products and Agricultural Service Solutions Department (SPM), establishing a branch of PVCFC - Ca Mau Fertilizer Plant, and establishing a representative office in Cambodia.

Researching to diversify high-quality fertilizers to meet the demand and the development trend of agriculture: products containing Nitrate from added-NH3 when increasing the plant capacity such as SOP, HNO3, CAN, UAN, DMC, etc. in which, the report on SOP production opportunity has been approved and the project investment preparation is being implemented to early launch products in high-quality fertilizer market.

Continuing to research NPK specifically for fruit trees and vegetables and NPK for rice plants; evaluating effectiveness on rice plants in greenhouse condition, soluble NPK, growth stimulant and foliar for automatic irrigation, and deploying demonstration models to approach the market for high-end NPK lines. PVCFC has currently produced 35/64 registered NPK formulas.

In January 2025, PVCFC marked a new milestone in its development journey when deploying a potential business segment – urban agriculture. With the optimal product and service kit driven to smart urban agriculture which is easy to apply and suitable to the conditions and living space of each household in the city. The product kit includes quality fertilizers designed and packaged to be suitable to the needs of urban customers; new generation plant protection products that are safe for users; organic/inorganic fertilizers providing comprehensive nutrients for plants to grow healthily and safely; a variety of high-quality substrates and seeds; full gardening tools for all plant care needs, high-tech planting solutions suitable for different conditions, and professional technical consulting services. PVCFC not only focuses on selling fertilizers but also invests in providing service-oriented nutrition solutions, a comprehensive farming solution from large-scale rural production to urban areas.

The Company saved a total of VND 226.78 billion (of which VND 223.33 billion was saved from raw materials and energy and VND 3.45 billion from other activities). The Company has made a cost plan for each unit to implement, and at the same time, checked and managed the arising costs to ensure compliance with regulations and the approved plan. The Company also balanced the cash flows to have flexible and effective management and usage solutions.

PVCFC focuses on training and improving the management, professional and technical skills for all employees. In addition, the Company builds human resources who are ready to undertake the works as the Company’s needs, especially the human resources for new areas such as postharvest processing, experimental farms, urban agriculture, international business, and digital transformation. The Company also builds a team of internal lecturers to not only help employees to develop themselves but also contribute to building the Company into a Learning - Leading - Creative organization.

The Company focuses on training human resources holding key positions, who can perform well in various management positions and are ready for internal rotation. The team of experts and lecturers are also regularly trained to improve their knowledge and skills. The Company has also developed and issued regulations on expert management, thereby approving the expert personnel plan and supplementing some fields until 2025, including 55 people in 30 fields.

PVCFC creates a favorable condition for candidates/experts to participate in research, innovation and optimization, and at the same time assigns candidates/experts to participate in maintenance, operation, and technical consulting for other units such as Thai Binh 2 Thermal Power Plant, BSR, VNPOLY, and Nghi Son Oil Refinery to share and learn experiences. In addition, the Company organizes seminars with NSRP, PVFCCo, and PuPuk Kaltim in Indonesia to develop human resources with specialized knowledge and experience to successfully implement the Company’s strategic goals, contributing to building and effectively using the team of experts in the units and in the Group.

PVCFC’s financial overview in 2024

- The Company’s business activities were promoted effectively in 2024, in which, total consolidated assets reached VND 15,729 billion, an increase of 3.2% compared to December 31, 2023 and net revenue/total asset ratio reached 0.86 times, an increase of 3.7% compared to 2023.

- Working capital in cash and bank deposits, accounted for 57% of capital structure, which is able to support continuous production and new investment for business expansion.

- Profitability ratios improved significantly, in which ROA, ROE, and ROS reached 9.22%, 14.18%, and 10.61% respectively.

Bad payables/bad receivables/bad assets affecting business performance

- The Company’s payables are always processed on time. Payables ratio at the end of 2024 remained at 35%, equal to 2023, ensuring stability in managing payables.

- The Company’s equity/debt ratio was about 1.8 times, showing a safe financial structure.

Current debt situation/major fluctuations in debt

- In 2024, in addition to short-term loans serving the need of working capital for production and business, to acquire KVF, the Company got a medium-and-long-term loan, increasing the debt balance. However, debt-to-total-asset ratio and debt-to-equity ratio remained low, at 8.6% and 13.3%, respectively.

Receivables

- The Company continues to implement strict control policies to limit the risk of arising bad debts.

Foreign exchange difference

- In addition to the key domestic market, the Company’s import and export activities are kept in balance; therefore, the impact from exchange rate is insignificant.

ASSESSMENT REPORT ON SOCIAL AND ENVIRONMENTAL RESPONSIBILITIES

On the journey of value creation, in addition to the goal of revenue and profit growth, PVCFC constantly strives to ensure corporate responsibility on two main foundations which are contributing to society and preserving the environment to build sustainable values.

CORPORATE SOCIAL RESPONSIBILITY (CSR)

- Supporting farmers: Not only providing highquality fertilizers, the Company accompanies farmers in organizing training programs and livestreams to share cultivation techniques and communicate about demonstration models, recommending adequate and appropriate fertilization for each stage, developing applications such as the 2Nong app, AI for pest diagnosis and so on. Thanks to that, the farmers are equipped with knowledge and skills to optimize cultivation, achieving the best productivity.

- Contributing to education: The Company has cooperated with the Department of Education of Ca Mau Province to build an educational ecosystem through activities such as establishing 10 “Books and Action” Clubs at high schools and holding career exploration tours for more than 1,500 high-school students in Ca Mau Province. The Company also regularly maintains support activities at the beginning of each school year and donates a scholarship fund for students nationwide with a desire to nurture the future generation.

- Other corporate social responsibility activities: PVCFC regularly participates in programs such as building schools and hospitals, supporting people affected by natural disasters, building residential areas in Kho Vang village after storm Yagi. The Company also funds for installing lights for street and bridges in rural areas, planting protective forests, supporting farmers in the Mekong Delta affected by saline intrusion leading to lack of domestic water, etc. Through corporate social responsibility activities, PVCFC not only helps the community but also brings Ca Mau Fertilizer brand closer to farmers. PVCFC has contributed 300,000 trees from 2022 - 2025 in response to the “1 billion green trees” project for the period 2021 - 2025, by the Prime Minister.

ENVIRONMENTAL RESPONSIBILITY

- PVCFC constantly researches, innovates, invests in modern technology and applies energy-saving solutions as well as actively participates in programs to reduce greenhouse gas emissions and minimize environmental impacts. Some of the works include implementing a project to produce CO2 for food, researching CO2 recovery from Fuel gas/Natural gas, piloting H2 production, assessing the feasibility of integrating H2 from electrolysis/green H2 into the project of increasing NH3 plant capacity by 125%, researching the market (raw materials and products), discussing with technology copyright owners and assessing (technically) the ability to produce Sorbitol from H2 and CNTs from CH4 at Ca Mau Fertilizer Plant.

- Security, safety, environment and fire prevention are always closely monitored to ensure the factory operates safely and stably, keeping the working environment tidy and clean, minimizing impacts on the surrounding environment. During the year, there have been no accidents or incidents affecting working hours at PVCFC. The Company closely monitors subcontractors to ensure safety and quality in ongoing projects. The company also maintains and improves the ISO 14001:2015 environmental management system and the ISO 45001:2018 occupational health and safety management system.

- PVCFC has installed 05 automatic environmental monitoring stations (including 3 gas monitoring stations and 2 water monitoring stations) to continuously monitor emissions and wastewater, then directly transmit data to the Department of Natural Resources and Environment of Ca Mau Province. The Company also fulfills its responsibility to recycle commercial packaging used by declaring the volume of recycled packaging on EPR portal of the Ministry of Natural Resources and Environment. The Company conducts environmental monitoring 4 times a year as committed in the environmental impact assessment report and publicly discloses the monitoring results on the Company’s website. In addition, to ensure stricter control of discharge, the plant periodically takes samples for analysis during each shift, complying with the requirements of the law on environmental protection. Discharge parameters always meet the current regulations. Solid waste (including domestic waste, industrial solid waste and hazardous waste) is classified, collected and treated in accordance with regulations.

Up to now, the Plant has always operated safely and stably without any major incidents related to occupational safety, health, fire or environment. Environmental indicators always meet current standards, and have been recognized by competent authorities for good performance in occupational safety, health and environmental protection through specialized and interdisciplinary inspections and assessments by independent organizations and State agencies.

2025 BUSINESS PLAN

Entering 2025, the world’s political situation is still complicated with prolonged wars and conflicts while climate change tends to be increasingly extreme and unpredictable, leading to fierce competition in gas supply for power/fertilizer production. Crude oil price is expected to enter a new growth cycle, significantly affecting the production and business efficiency of many enterprises. Given those challenges, the world’s situation shows positive signs when the new US Government has a policy supporting peace and economic development. In Vietnam, the Government has introduced solutions to streamline the state apparatus and has drastic directions in investment activities such as the investment in building an AI center. In particular, according to the Law on Value Added Tax (amended) approved in November 2024, the VAT of 5% applied to fertilizers is expected to promote the growth of agricultural sector as farmers benefit from fertilizer prices while domestic fertilizer manufacturers can increase their competitiveness with imported fertilizers. In addition, the trend of green consumption, green agriculture, and plant nutrition solutions are also the solid foundations for PVCFC to enter 2025 with the motto “Stronger Aspiration - Faster, More Effective”, which is also a fundamental momentum for the final year of the 2021 - 2025 period to step into the era of national growth in the 2026 - 2030 period. Along with the Government’s goals, Vietnam Oil and Gas Group and PetroVietnam Ca Mau Fertilizer Joint Stock Company continue to set out the 2025 plan with challenging tasks, solutions and targets to submit to the General Meeting of Shareholders as follows:

KEY TASK IN 2025

PVCFC’S TARGETS IN 2025

Production output

| NO. | INDICATORS | UNIT | 2025 PLAN |

|---|---|---|---|

| I | PRODUCTION INDICATORS | ||

| 1 | Manufactured products | ||

| 1.1 | Converted Urea | thousand tons | 910 |

| In which: - Functional fertilizers | thousand tons | 120 | |

| 1.2 | NPK (produced by PVCFC) | thousand tons | 220 |

| 1.3 | NPK (produced by KVF) | thousand tons | 120 |

| 2 | Consumed products | ||

| 2.1 | Urea | thousand tons | 759 |

| 2.2 | Functional fertilizers | thousand tons | 120 |

| 2.3 | NPK (produced by PVCFC) | thousand tons | 220 |

| 2.4 | NPK (produced by KVF) | thousand tons | 120 |

| 2.5 | Self-trading fertilizer | thousand tons | 280 |

Financial plan

| NO. | INDICATORS | UNIT | 2025 PLAN |

|---|---|---|---|

| I | FINANCIAL INDICATORS (CONSOLIDATED COMPANY) | ||

| 1 | Total revenue | billion VND | 13,983 |

| 2 | Profit before tax | billion VND | 864 |

| 3 | Profit after tax | billion VND | 774 |

| II | FINANCIAL INDICATORS (THE PARENT COMPANY) | ||

| 1 | Equity | billion VND | 9,972 |

| 2 | Total revenue | billion VND | 13,251 |

| 3 | Profit before tax | billion VND | 853 |

| 4 | Profit after tax | billion VND | 764 |

| 5 | Profit before tax/equity ratio | % | 9% |

| 6 | Investment and development fund (30% of profit after tax) | billion VND | 229 |

| 7 | Investment in basic construction & equipment purchase | ||

| 7.1 | Total investment capital requirement | billion VND | 771 |

| - | Investment in basic construction & equipment purchase | billion VND | 771 |

| - | Contributed capital to member units | billion VND | - |

| 7.2 | Source of Capital Investment | billion VND | 771 |

| - | Equity | billion VND | 395 |

| - | Other loans | billion VND | 376 |

LONG-TERM INVESTMENT AND DEVELOPMENT PLAN

With the achieved investment results, in 2025 PVCFC will continue to implement 7 transitional projects (5 group B projects and 2 group C projects); deploy 5 new projects (2 group B projects and 3 group C projects) and prepare to seek investment opportunities for 7 projects, as follows:

Transitional projects

| NO. | NAME OF PROJECTS | GROUP | |

|---|---|---|---|

| I | TRANSITIONAL PROJECTS | ||

| 1 | Thanh Hoa - PVCFC Center for Research, Application and Transfer of High-tech Agricultural Production Technology | B | |

| 2 | PVCFC Nhon Trach Plant, Port and Warehouse | B | |

| 3 | Expanding canopy for the dispatch area of Ca Mau Fertilizer Plant (Line A&D) | B | |

| 4 | Additional Warehouse of 12,000 tons | B | |

| 5 | Houses for employees of PetroVietnam Ca Mau Fertilizer Joint Stock Company - LC | B | |

| 6 | Food CO2 production project at Ca Mau Fertilizer Plant | C | |

| 7 | Ca Mau Fertilizer Plant in Binh Dinh | C | |

PVCFC’S TARGETS IN 2025 (Continued)

Newly invested projects and projects to be invested

| NO. | NAME OF PROJECTS | GROUP | INVESTMENT PURPOSE | INVESTMENT CAPITAL |

|---|---|---|---|---|

| II | NEWLY INVESTED PROJECTS | |||

| 1 | Industrial Gas Production at Ca Mau Fertilizer Plant | B |

Implementing the strategic goal of diversifying raw

material sources for production, the Company has

researched to recover Nitrogen and Argon from

Offgas and refine to meet industrial gas standards,

serving the increase of Urea and Ammonia

workshop capacity in the future as well as meeting

the demand of industrial gas in domestic market,

contributing to improving the efficiency of raw

material sources according to the Group’s energy

transition orientation. The project was approved in the Decision No. 3821/ QD-PVCFC dated January 16, 2025. |

Estimated investment value is VND 288.35 billion. |

| 2 | Bulk cargo export cluster (canopy and dispatch technology system) | B | To optimize costs and time for export production and quickly respond to partner requirements, the Company plans to invest in a bulk export system. | Estimated investment value is VND 216.19 billion. |

| 3 | Self-produced and self-consumed rooftop solar power 5MWp - Ca Mau Fertilizer Plant | C | With increasingly expanding production, leading to higher electricity consumption, to take advantage of the sunny conditions in Ca Mau, PVCFC is preparing FS for the project of self-produced and self-consumed solar power to reduce power cost, being proactive in power supply and improving operational efficiency. | Estimated investment value is VND 76.44 billion. |

| 4 | Build a swimming pool in the employee housing area | C | To improve the Company’s facilities, create the best living and working environment, and enhance welfare policies for employees. | Estimated investment value is VND 31.44 billion. |

| 5 | Road E8 Cover Project | C | Along with investing in canopy for bulk cargo area, a roof cover for dispatching road is necessary and needs to be deployed synchronously to ensure the goal of cargo handling in all weather conditions. | Estimated investment value is VND 26.09 billion. |

| NO. | NAME OF PROJECTS | GROUP | INVESTMENT PURPOSE | NVESTMENT CAPITAL |

|---|---|---|---|---|

| III | PROJECT TO BE INVESTED | |||

| 1 | Warehouse project in Can Tho | B | To complete warehouse system, enabling the Company to be proactive in implementing production and business plans as well as storing and supplying, acting as a focal point serving the target markets. | FS progress |

| 2 | Warehouses in An Giang and Dong Thap | B | To complete warehouse system, enabling the Company to be proactive in implementing production and business plans as well as storing and supplying, acting as a focal point serving the target markets. | FS progress |

| 3 | Industrial Gas Production Plant | B | Implementing the strategic goal of diversifying raw material sources for production, the Company has researched to recover Nitrogen and Argon from Offgas and refine to meet industrial gas standards, serving the increase of Urea and Ammonia workshop capacity in the future as well as meeting the demand of industrial gas in domestic market, contributing to improving the efficiency of raw material sources according to the Group’s energy transition orientation. | FS progress |

| 4 | Plant of Agricultural product processing for export | B | To join the agricultural processing and export market according to the Company’s strategic orientation to take advantage of existing strengths, contributing to supporting and creating added values for agricultural products, increasing the Company’s revenue and profit. | FS progress |

| 5 | Increasing capacity of Ca Mau Fertilizer Plant | B | To increase NH3 output for Urea production, contributing to increasing the Company’s revenue and profit. | FS progress |

| 6 | Building warehouse and port to serve import and export at KVF Plant | B | To complete warehouse system, enabling the Company to be proactive in implementing production and business plans as well as storing and supplying, acting as a focal point serving the target markets. | FS progress |

| IV | OTHER INVESTMENTS | |||

| 1 | Microbial organic fertilizer plant (M&A, capital contribution, cooperation) | At present, PVCFC is conducting a trial business of organic microbial fertilizers to evaluate market absorption and seek opportunities for organic products towards M&A or business cooperation to expand the scale and product range. | FS progress | |