RISK MANAGEMENT

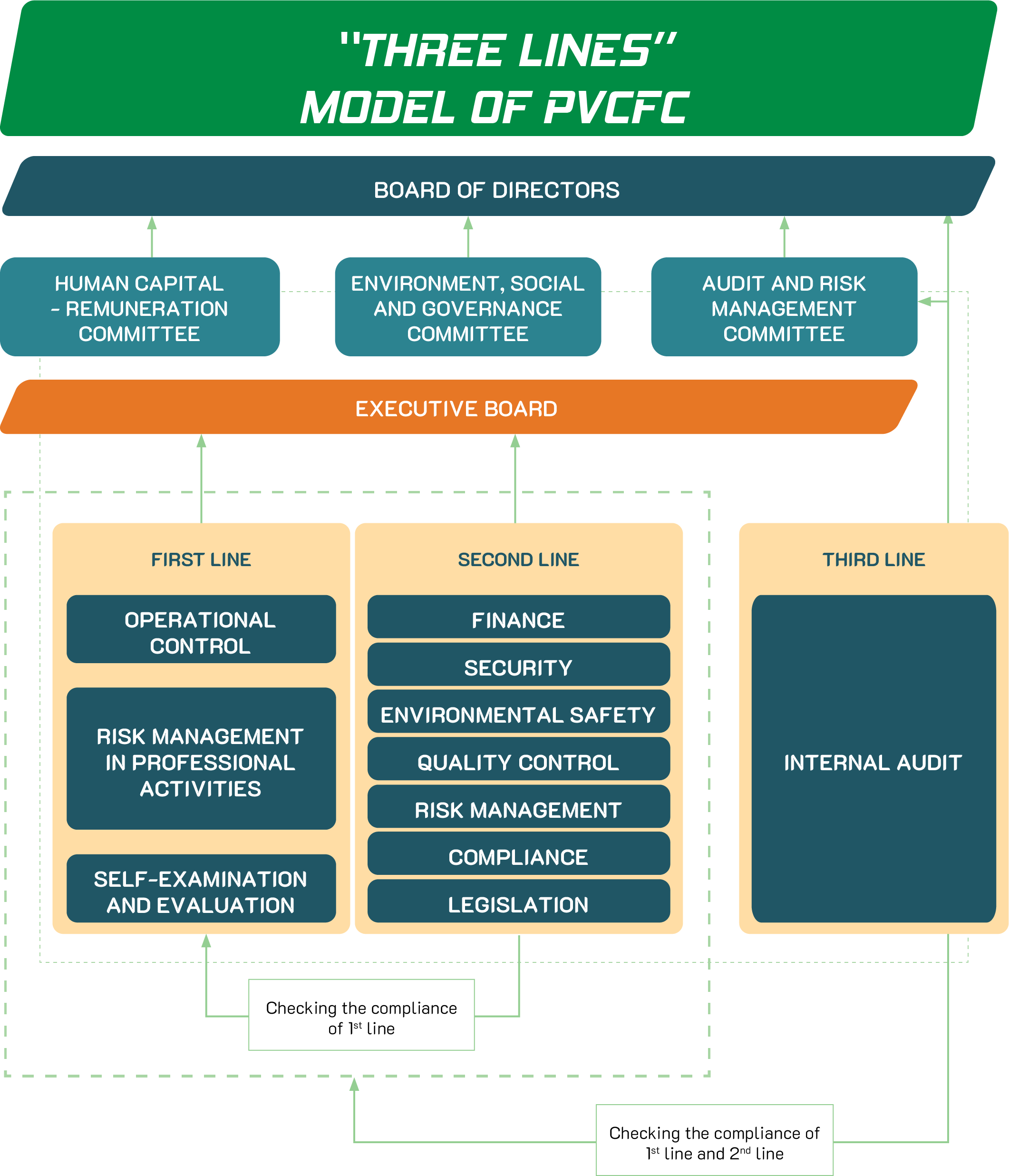

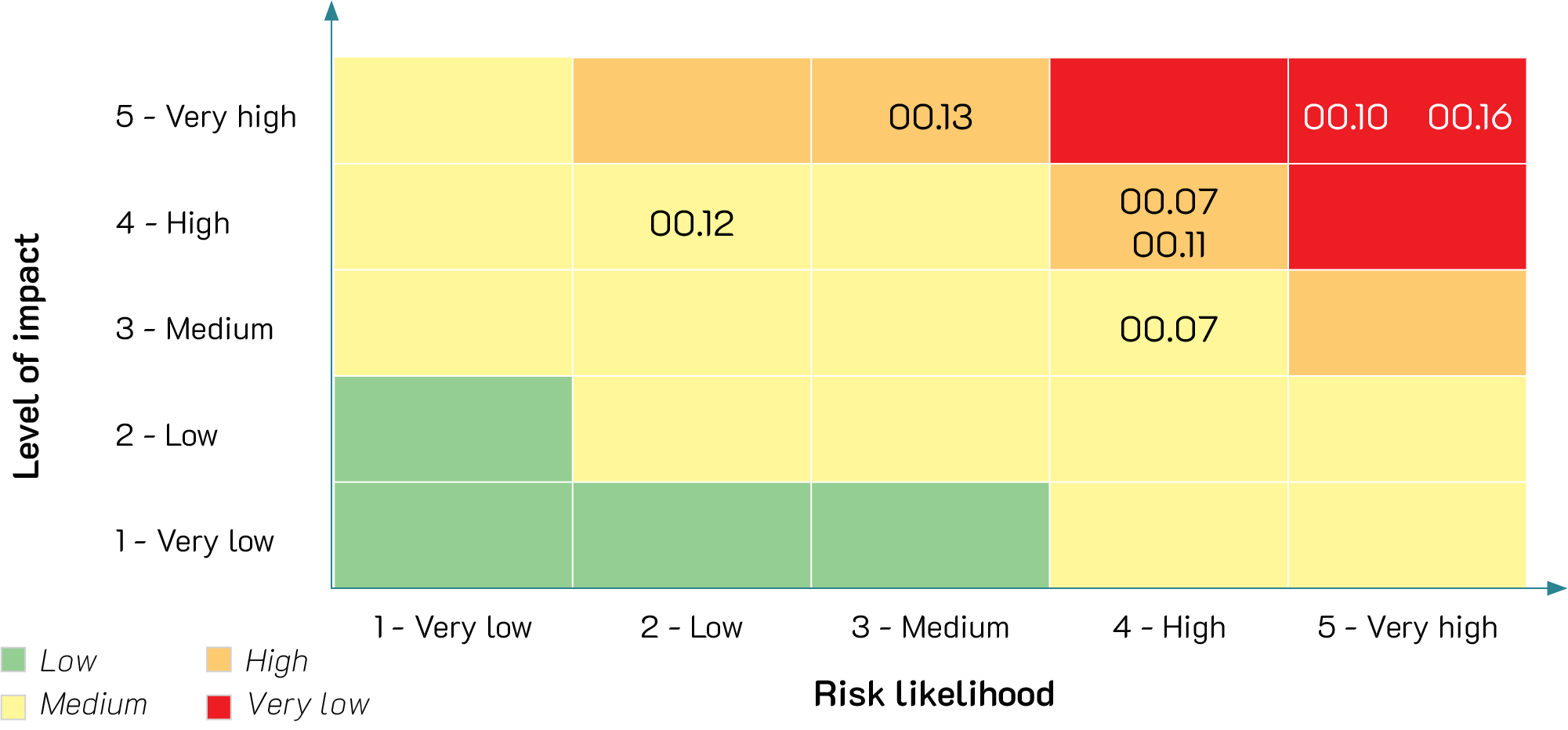

Pandemic, economic crisis, supply chain disruption and global political instability have shown that the business’s survival and development can be threatened without a proper risk management strategy. Given the constantly changing markets and unexpected economic shocks, risk management has become an indispensable element for enterprises. With the goal of increasingly perfecting and standardizing the risk management system which was built from the early stage, in 2024 PVCFC continued to focus on synchronously implementing activities based on the components of the system, including risk management and culture, strategy and target setting, operational performance, reviewing and improving the system as well as promoting information, communication and report.