INFORMATION OF BOD MEMBERS, COMMITTEES, INTERNAL AUDIT DIVISION

BOD MEMBERS

List of BOD members as of December 31, 2024 is as follows:

| NO. | BOD MEMBERS | POSITION | APPOINTMENT DATE | SERVING TIME |

|---|---|---|---|---|

| 1 | Mr. Tran Ngoc Nguyen | Non-executive Chairman | 10/01/2019 | 06 years |

| 2 | Mr. Van Tien Thanh | Executive BOD member cum General Director | 12/6/2018 | 6 years 7 months |

| 3 | Mr. Nguyen Duc Hanh | Non-executive Director Chairman of the ESG Committee |

25/6/2020 | 4 years 6 months |

| 4 | Mr. Le Duc Quang | Non-executive Director Member of the ESG |

25/6/2020 | 4 years 6 months |

| 5 | Mr. Nguyen Duc Thuan | Non-executive Director , Member of the Audit and Risk Management Committee |

10/01/2024 | 01 year |

| 6 | Mr. Truong Hong |

Independent Director Chairman of the Human Capital - Remuneration Committee Member of the Audit and Risk Management Committee |

27/4/2021 | 3 years 8 months |

| 7 | Ms. Do Thi Hoa | Lead Independent Director Chairwoman of the Audit and Risk Management Committee Member of the Human Capital and Remuneration Committee |

27/4/2021 | 3 years 8 months |

Share ownership of BOD members

| No. | BOD member | Position | Appointment date for BOD

member/ independent BOD member |

Share ownership | |||||

|---|---|---|---|---|---|---|---|---|---|

| Direct | Indirect | ||||||||

| Number of

shares (as of January 01, 2024) |

Number of

shares (as of December 31, 2024) |

Ownership/Charter capital (%) | Number of

shares (as of January 01, 2024) |

Number of

shares Number of shares |

Ownership/Charter capital (%) | ||||

| 1 | Mr. Tran Ngoc Nguyen | Non-executive Chairman | 10/01/2024 | 0 | 0 | 0% | 0 | 0 | 0 |

| 2 | Mr. Van Tien Thanh | Executive BOD member cum General Director | 12/6/2023 | 109,000 | 109,000 | 0.020589% | 300 | 300 | 0.000057% |

| 3 | Mr. Nguyen Duc Hanh | Non-executive Director | 25/6/2020 | 8,000 | 8.000 | 0.001511% | 0 | 0 | 0 |

| 4 | Mr. Le Duc Quang | Non-executive Director | 27/4/2021 | 0 | 0 | 0 | 0 | 0 | 0 |

| 5 | Mr. Nguyen Duc Thuan | Non-executive Director | 10/01/2024 | 0 | 0% | 0% | 0 | 0 | 0 |

| 6 | Mr. Truong Hong | TV HĐQT độc lập | 27/4/2021 | 0 | 0% | 0% | 0 | 0 | 0 |

| 7 | Ms. Do Thi Hoa | Lead Independent Director | 27/4/2021 | 0 | 0 | 0% | 0 | 0 | 0 |

STRUCTURE OF BOD MEMBERS

For PVCFC, the performance of the Board of Directors is the top priority. PVCFC’s BOD well recognizes the importance of diversity of BOD members and ensures the best practices of this orientation. The Company’s internal governance regulations outline direction and policies on ensuring gender, age and professional skill diversity of BOD align with the Company’s long-term development strategy. Based on the business orientation in the coming years, BOD has set the following goals for the diversity of BOD by 2030:

- BOD has at least 02 independent directors who are female.

- BOD has at least 01 member with experience in Mergers and Acquisitions (M&A) to serve the production and business expansion.

- BOD has at least 01 member with experience in international markets to serve the production and business expansion.

- BOD has at least 01 member with experience in business strategy planning.

In 2024, as assessed by the BOD, BOD member structure was appropriate at the present time, ensuring diversity in BOD. BOD members with different expertise, skills and experiences have ensured the operational efficiency of BOD. At present, there is 01 independent director who is female. In the coming years, BOD will continue to pursue the abovementioned goals to ensure diversity as well as operational efficiency.

| NO. | CRITERIA/ FULL NAME | MR. TRAN NGOC NGUYEN | MR. VAN TIEN THANH | MR. NGUYEN DUC HANH | MR. LE DUC QUANG | MR. NGUYEN DUC THUAN | MS. DO THI HOA | MR. TRUONG HONG |

|---|---|---|---|---|---|---|---|---|

| 1 | Position in the Board of

Directors/ participation in the Executive Board |

Non-executive Chairman | Executive BOD member cum General Director | Non-executive Director | Non-executive Director | Non-executive Director | Lead Independent Director | Independent Director |

| 2 | Gender | Male | Male | Male | Male | Male | Female | Male |

| 3 | Age | 47 | 56 | 52 | 48 | 49 | 64 | 65 |

| 4 | Qualification | Ph.D. in Chemical,

Engineering, Master’s degree in Economic Management |

Agricultural and Forestry Mechanical Engineer | Engineer in Energy Economics | Master of Business

Administration, Chemical Engineer Petrochemical |

Engineer of Transport Economics | Bachelor of Industrial Accounting | Doctor of Agriculture, major in Soil and Fertilizer |

| 5 | Audit & Risk Management Committee | - | - | - | - | Member | Chairwoman | Member |

| 6 | Human Capital and Remuneration Committee | - | - | - | - | - | Member | Chairman |

| 7 | ESG Committee | - | - | Chairman | Member | - | - | - |

| 8 | Positions at other companies | No | No | No | No | Chairman of the BOD’s PPC | No | No |

PVCFC’s BOD currently consists of 01 executive member and 06 non-executive members (including 02 independent directors).

The Company’s Charter requires each director term should not exceed 05 years. An independent director should not sit in the board in more than 02 consecutive terms. A BOD member is allowed to be the BOD member at maximally 05 other companies, concurrently.

PVCFC’s BOD has 02 independent directors, ensuring the stipulations on the number of independent directors. The 02 current independent directors are both serving their first term. There is no BOD member who is the BOD member at more than 02 other companies.

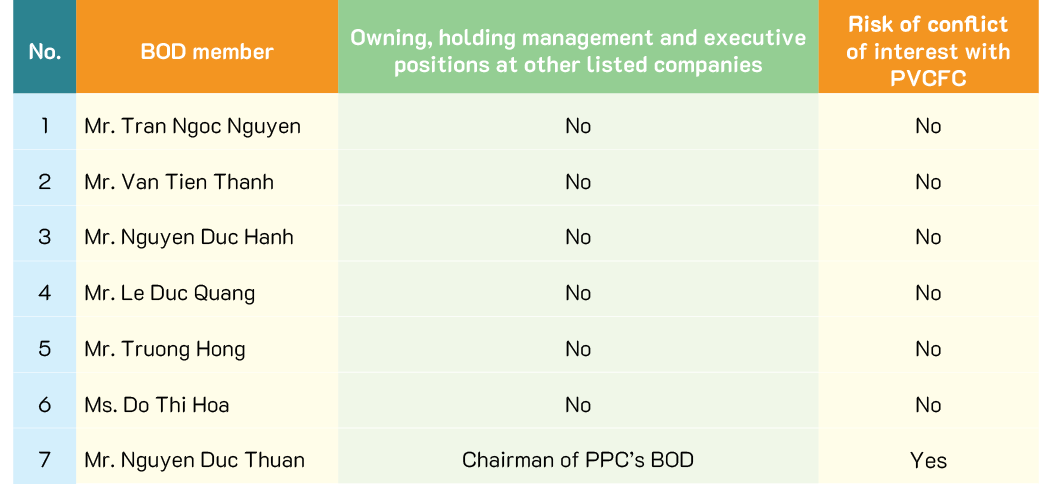

POSITIONS HELD AT OTHER ORGANIZATIONS OF BOD MEMBERS AND CONFLICTS OF INTERESTS RELATED TO PVCFC

Except for BOD member Nguyen Duc Thuan, elected since January 10, 2024, who is currently holding the position of BOD Chairman of Vietnam Petroleum Packaging Joint Stock Company (a subsidiary in which PVCFC holds 51.03% of charter capital), the other members do not hold management or executive positions at other related companies. There are no cross-owned suppliers or related parties.

CORPORATE SECRETARY - IN CHARGE OF CORPORATE GOVERNANCE

BOD has appointed a person in charge of corporate governance cum corporate secretary, Information about personnel in charge as follows:

Mr. DO THANH HUNG

Specialized training

- Engineer in Refining-Petrochemical Technology

- Bachelor of Political Economics

- Master of Business Administration

- CSMP-VIOD Corporate Secretary

- Director Certification (DCP-VIOD)

Working experience

- 1998 - 2006: R & D Center for oil and gas processing - Vietnam Oil and Gas Group.

- Conducting research and analysis on the quality of crude oil of crude oil and petroleum products and petroleum products.

- Conducting research, assessing, evaluating petroleum market and products; setting, appraising and managing investment projects

- 2006 - 2011: Petroleum Finance Corporation - HCMC branch.

- Proposing, implementing and managing project investment, financial investment and services in financial companies

- 2011 - 2016: Vietinbank - Branch No 7, HCMC.

- Planning.

- Banking risk management, dealing with debt problems.

- Managing quality systems according to ISO.

- 2016 - now: PetroVietnam Ca Mau Fertilizer JSC.

- He has legal expertise and experience in fields of investment, finance, banking, law on enterprise, expertise and experience in field of petroleum processing (main business line of PVCFC), corporate governance to advise and consult BOD in corporate governance.

Primary duties of Corporate Secretary

- Supporting to organize the GMS; taking meeting minutes;

- Supporting BOD members with their completion of rights and obligations;

- Supporting BOD to apply and implement corporate governance principles;

- Supporting the Company to build investor relations and protect rights and interests of shareholders; compliance with the obligations of information provision, information disclosure and administrative procedures.

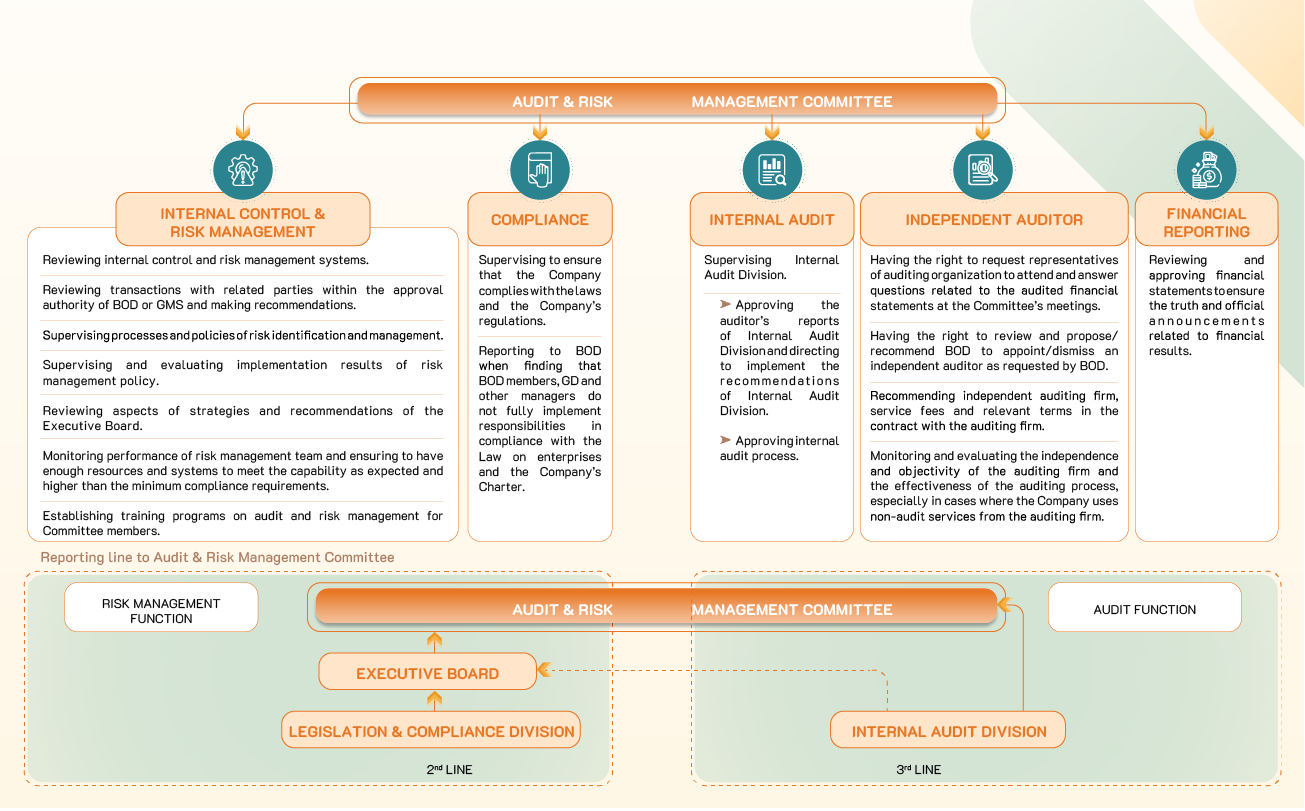

COMMITTEES UNDER BOD

BOD has established 03 sub-committees as follows:

BOD assesses that the structure, scale and composition of Committees under BOD are appropriate to the actual conditions of the Company. The Committees support BOD with good performance of its roles of supervising and promoting the general strength, enhancing the importance and effectiveness of BOD in the Company.

Information about meetings and member participation of committees (in 2024):

| NO. | COMMITTEE | ATTEND THE MEETING |

|---|---|---|

| 01 | Audit & Risk Management Committee | Number of meetings: 07 |

| Lead Independent Director, Ms. Do Thi Hoa - Chairwoman | 7/7 | |

| Independent Director, Mr. Truong Hong | 7/7 | |

| Non-executive Director, Mr. Nguyen Duc Thuan | 7/7 | |

| 02 | Human Capital - Remuneration Committee | Number of meetings: 11 |

| Independent Director, Mr. Truong Hong - Chairman | 11/11 | |

| Lead Independent Director, Ms. Do Thi Hoa | 11/11 | |

| 03 | ESG Committee | Number of meetings: 04 |

| Non-executive Director, Mr. Nguyen Duc Hanh – Chairman | 4/4 | |

| Non-executive Director, Mr. Le Duc Quang | 4/4 |