the steadfast internal strength

Fertilizer industry overview 2022

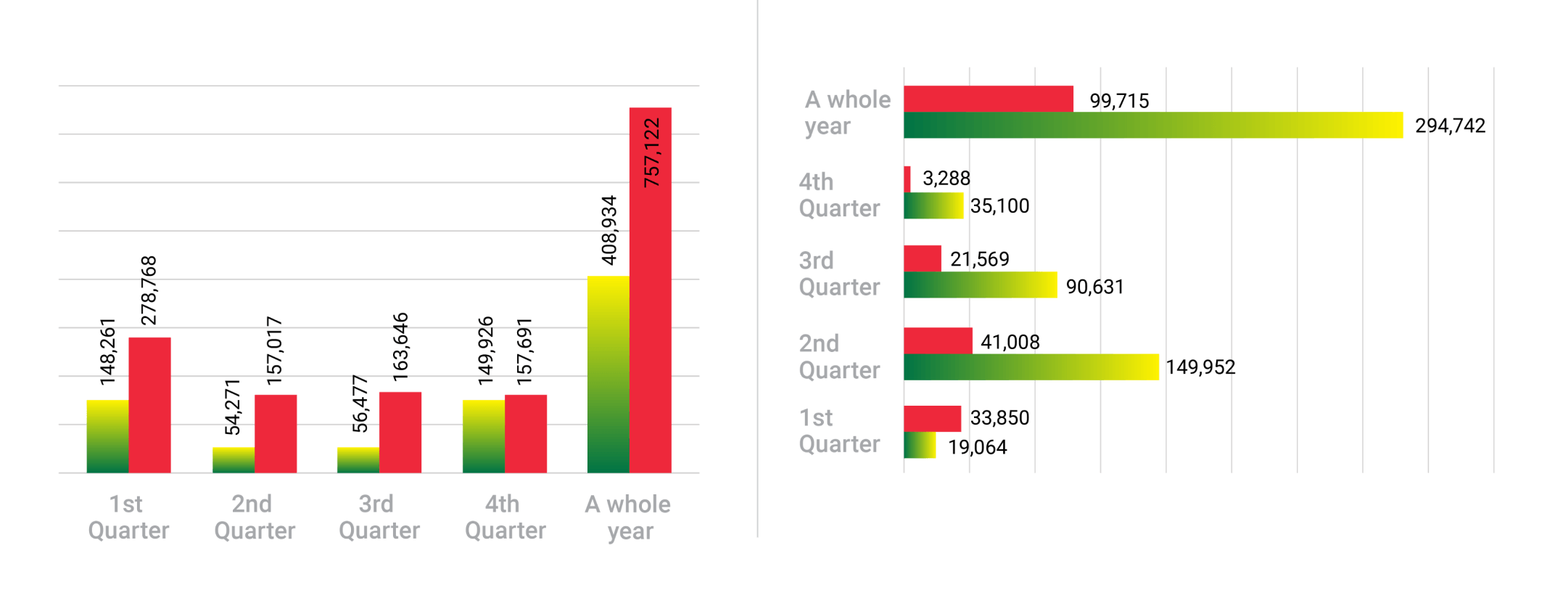

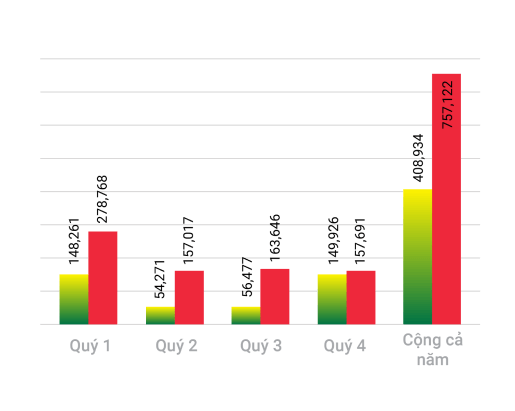

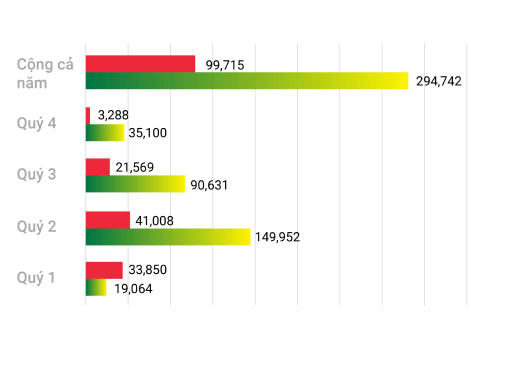

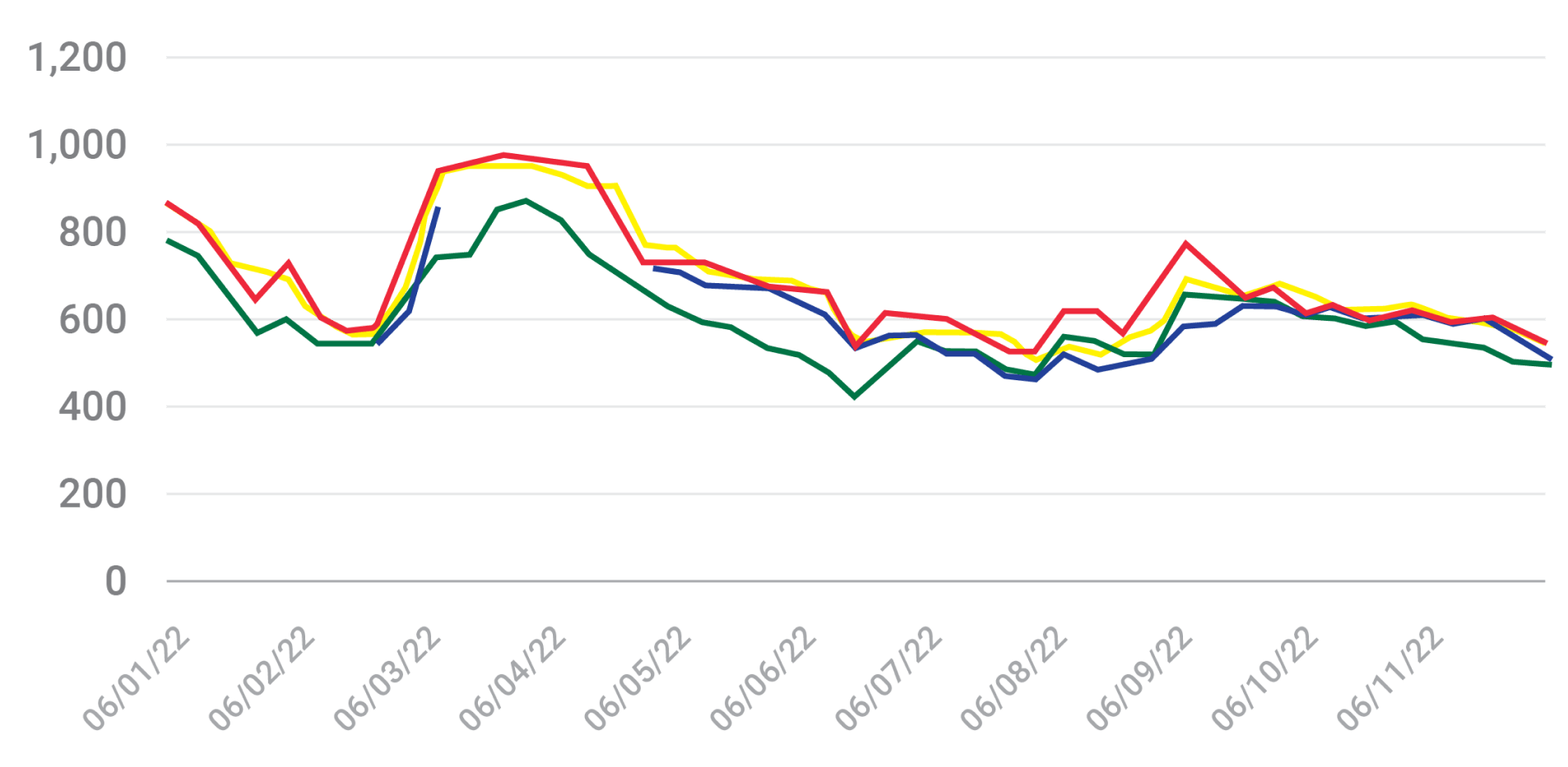

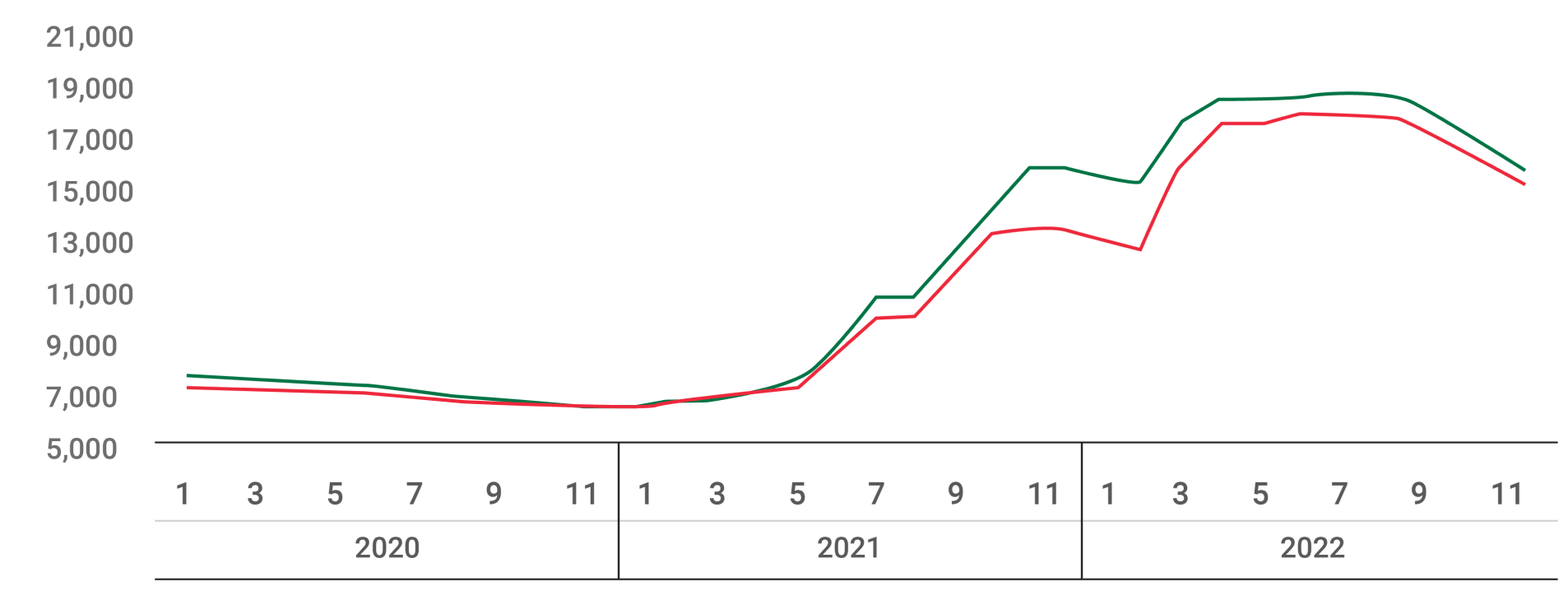

After peaking at the end of the first quarter of 2022, the world urea price decreased and entered a sharp decline in the fourth quarter of 2022, equivalent to a decrease of about 50% while the demand in the main markets continued to decrease due to the influence of many different reasons.

The year 2022 witnessed the military conflict between Russia and Ukraine that broke out on February 24, 2022 and has lasted until now. Although this war took place in Europe, it had an impact on a global scale, considerably affecting many different markets such as energy, food, finance, currency, and securities because Russia has a role and position as a leading exporter of oil, gas, fertilizer, wheat... Regarding the energy market, the reduction of oil and gas exports from Russia due to the US trade embargo and sanctions The EU caused the oil and gas market to wobble. In addition, in the field of fertilizers, Russia applies a policy to restrict fertilizer exports from January 1, 2022 to May 31, 2022 with 5.9 million tons and from July 1, 2022 to December 31, 2020. 2022 with 8.3 million tons to prevent shortage of domestic supply.

Regarding China, right from the fourth quarter of 2021, there has been a policy to reduce fertilizer exports to the world market. Specifically, on October 29, 2021, China controlled the export of 29 exported fertilizers, including Urea, DAP, MAP, NPK, NP/NPS, MOP... Currently, this policy has not been removed and remains in effect. The restraint on fertilizer exports, including Urea, caused a sharp decrease in supply, thereby, more positively supporting global urea prices in the context of tight supply in many key markets.

However, now, the market context has changed. Currently, China’s domestic urea price is higher than the world urea price.

The impact of the gas crisis in Europe led to many fertilizer plants shutting down. The peak was in August 2022, when gas prices increased, causing many large fertilizer companies in Italy, Norway, Germany, Poland, Lithuania, France, the UK and Hungary to simultaneously close or cut down operating capacity. The situation is so bad that, at times, fertilizer production capacity in Europe has decreased by a quarter of the normal level, even to 20% at some points.

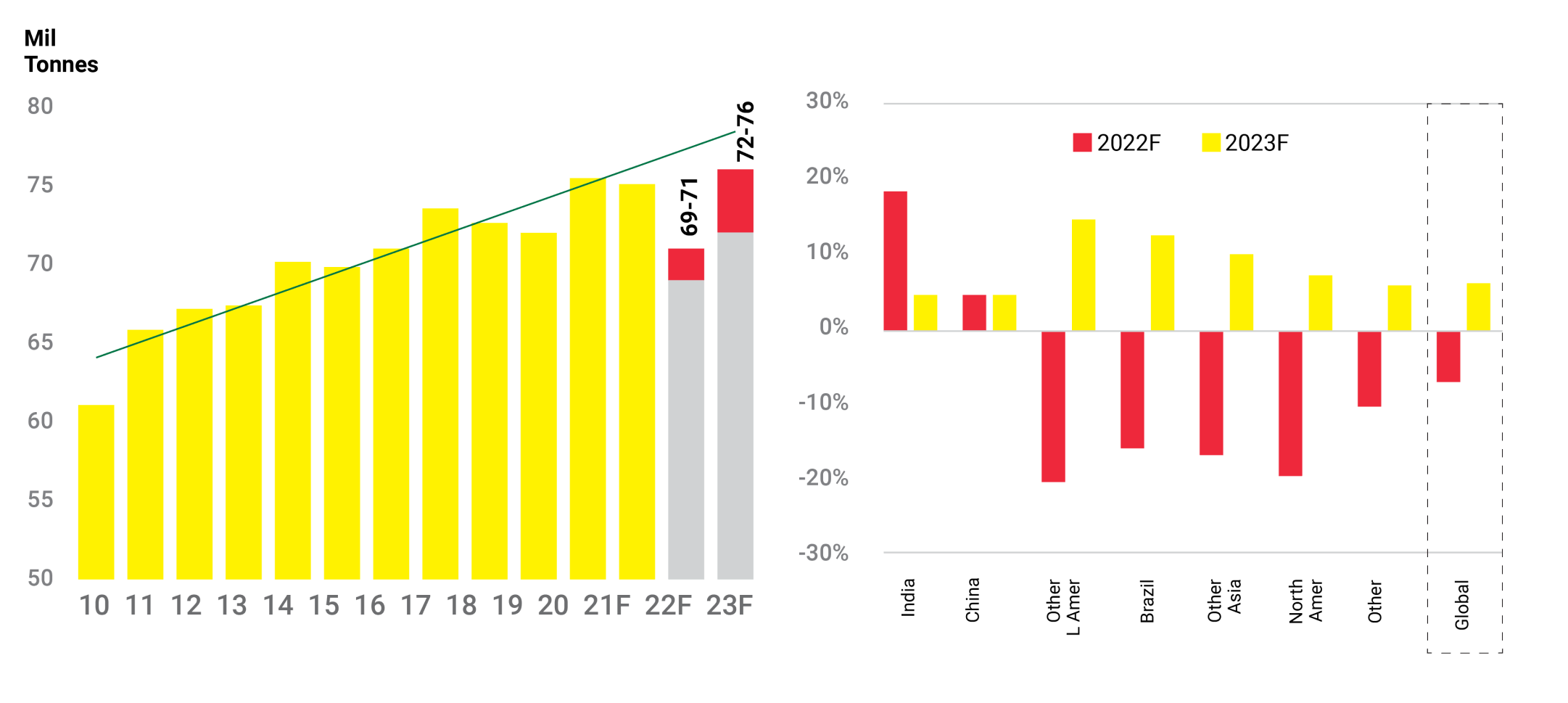

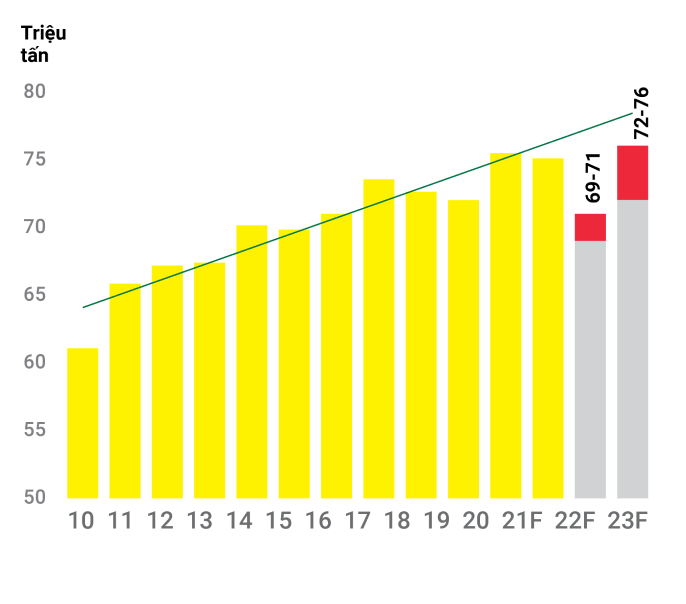

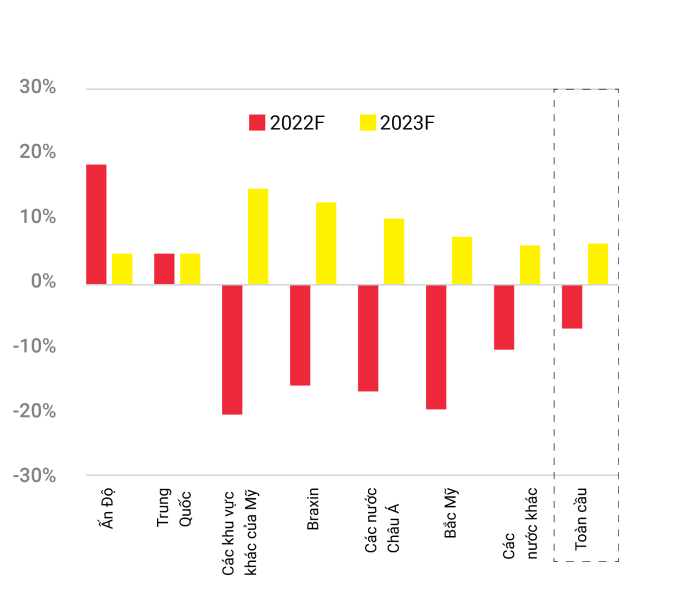

With a number of new plants coming into operation recently, the world has new sources of urea, notably many new plants located in Asia and the Middle East. This will contribute to increased competition in Southeast Asia in the coming time.

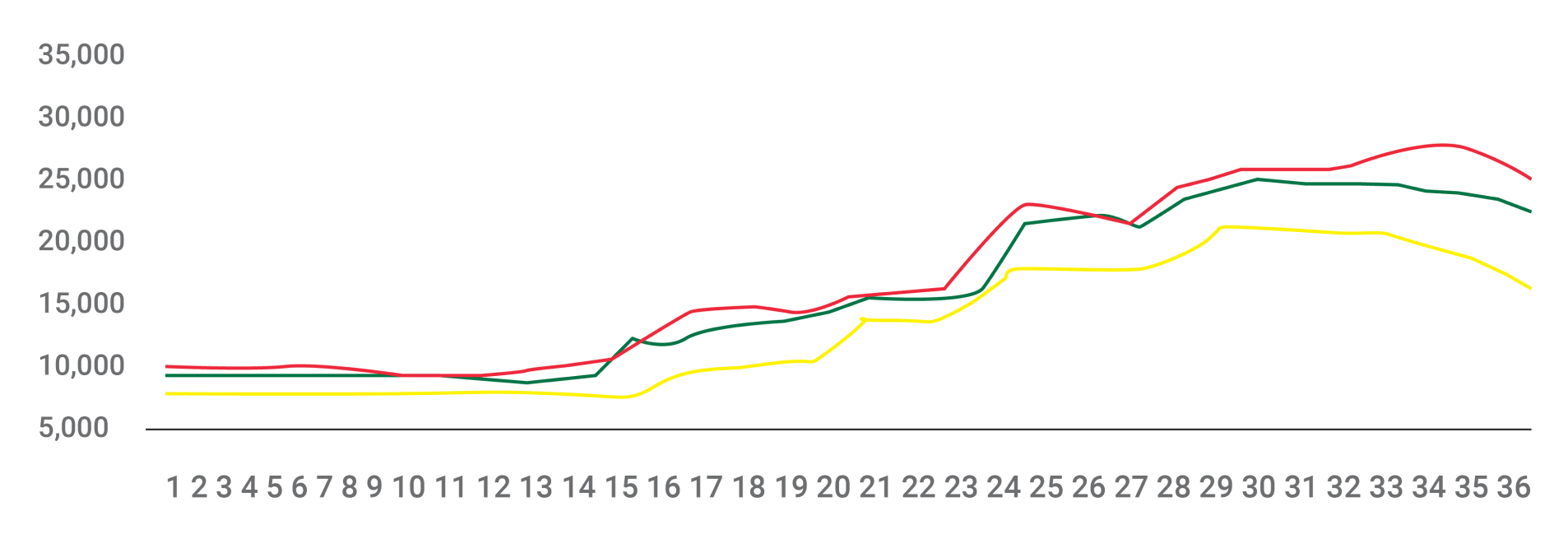

After peaking at the end of the first quarter of 2022, DAP prices in some markets have adjusted down by nearly 50% by the end of 2022. The decline in DAP prices in the third and fourth quarters of 2022 is in the general trend of the market. global fertilizer market.

The impact from the reduced supply of DAP makes the demand for DAP consumption in 2022 decrease by about 7% compared to 2021.Besides, because the price of DAP remains high for most of 2022, the demand will decrease accordingly.

Due to the impact of the Russia-Ukraine war that broke out in the first quarter of 2022, many countries have the mentality to buy fertilizer reserves to ensure food security, including Brazil, India, Pakistan..., leading to DAP inventories tend to increase rapidly in the first 6 months of 2022, last through the third quarter of 2022 and slow down in the fourth quarter of 2022.

After peaking in the main markets in Brazil and Europe at the end of the first quarter of 2022, the price of potassium quickly corrected down by the end of 2022. The decline in the price of potassium in the third and fourth quarter of 2022 is within General trend of the global fertilizer market. However, currently, the price of potassium in Europe is still higher than in other markets. The global demand for Potassium dropped sharply due to the impact of the narrow supply as well as the high potassium price in the first 6 months of 2022, causing buyers to delay their new purchase demand. Many large buying markets fell into a state of strong demand reduction such as North America, Europe, South America... However, according to experts, this trend may reverse in 2023.

The high price of agricultural products during the year also helps farmers improve their ability to pay for input costs, including fertilizers in general and potassium and DAP in particular.

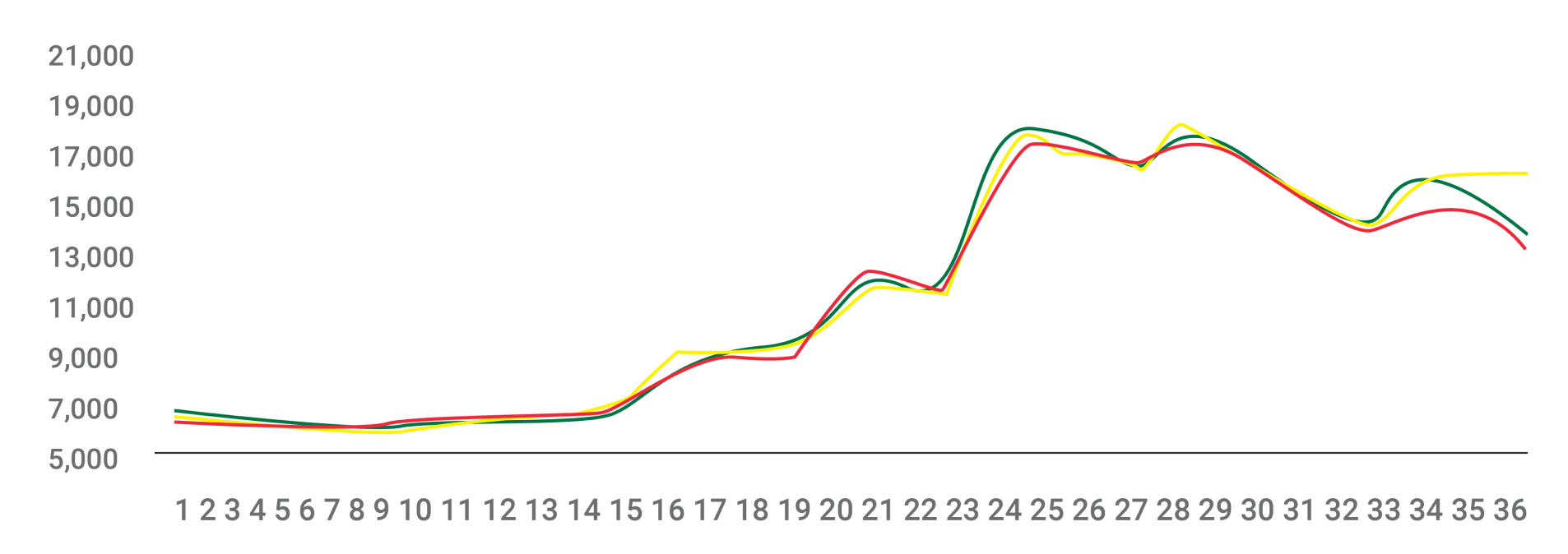

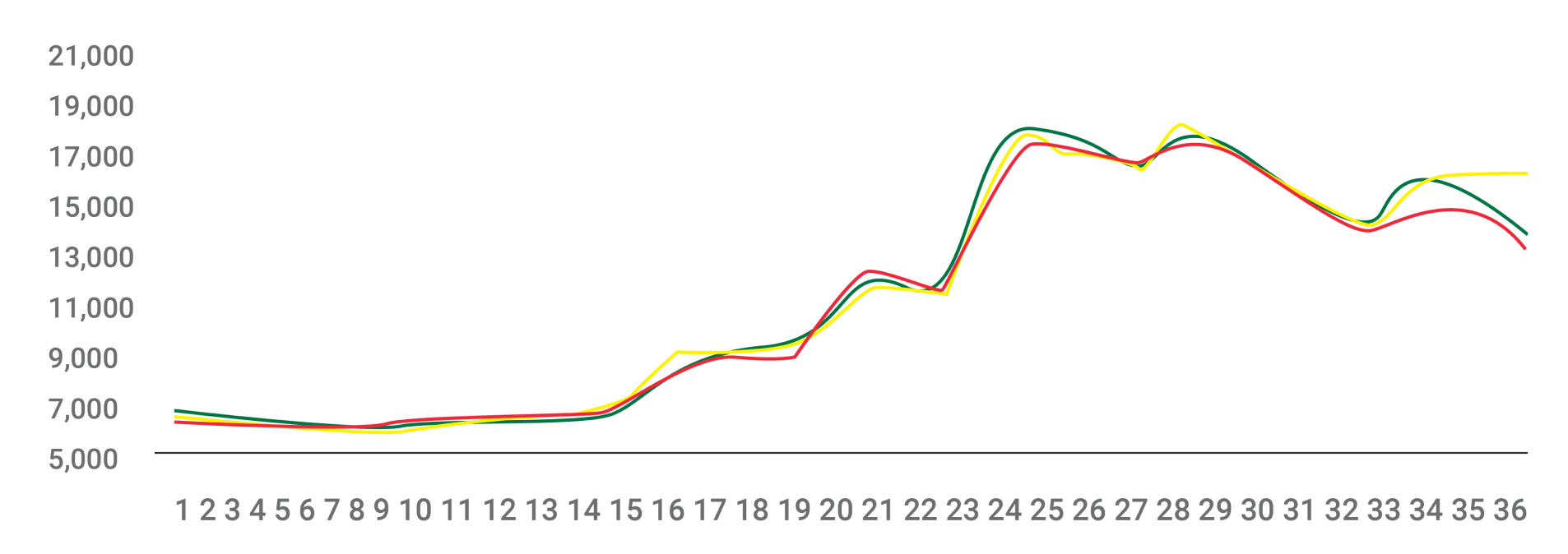

After peaking in the first quarter of 2022, the domestic urea price has continuously decreased at the end of the fourth quarter of 2022. Domestic demand dropped sharply for most types of fertilizers, including Urea, putting great pressure on domestic urea prices. In addition, the decline in world urea price also had a great impact on domestic urea price movements as well as the psychology of the distribution system.

Domestic urea supply is stable but weak demand also puts great pressure on manufacturers in the last 6 months of 2022. Many manufacturers actively deploy exports to lower inventories to a reasonable level. . Vietnam’s urea exports in 2022 will grow by 85% in volume compared to 2021 (excluding temporary imports for re-export), thereby contributing to improving fertilizer export revenue and reducing domestic inventories.

DAP prices remained high in the first quarter, second quarter and third quarter of 2022 but began to show signs of a stronger correction from the fourth quarter of 2022.

Potassium price in 2022 also has the same situation as DAP price, accelerating in the first quarter of 2022, maintaining a high level in the second and third quarters and entering a faster decline in the fourth quarter of 2022. Potassium prices fell later than Urea prices due to limited supply of potassium to Vietnam in the context of some traditional supplies in Russia and Belarus being limited due to the impact of US and EU sanctions. Vietnam’s potassium imports in 2022 decreased by nearly half compared to 2021 due to weak domestic demand as well as more difficult access to world supply.

NPK prices are generally more stable in 2022 compared to other single fertilizers such as Urea, DAP, and Potassium. This can be partly explained by the fact that NPK producers have imported raw materials earlier at high prices and the consumption cycle of NPK products has a certain delay compared to other types of fertilizers.

With the higher single fertilizer price level in 2022 than previous years, it also makes input production costs of NPK plants higher than in the previous period, which inhibits new purchase contracts of NPK plants in the domestic market.