the steadfast internal strength

BRINGING INSIDE

POTENTIAL POWER

FERTILIZER INDUSTRY 2023

World market

1.1. Urea market

- It is forecast that world urea consumption in 2023 will be improved, estimated at 187 million tons, up 2.7% compared to 2022, of which direct consumption is about 82%. Most of the urea produced is used for direct fertilization, used in the production of Ammonium Nitrate (UAN) and in NPK compound fertilizers. The remaining 18% of urea consumption is concentrated in industrial applications, manufacturing plastics used in the wood product industry, and controlling Nox emissions.

- Cereal is by far the largest urea demander globally, accounting for about 59% of nitrogen consumption. Maize/corn is the crop that receives the largest amount of nitrogen fertilizer and accounts for 20% of global demand, followed by wheat with 18% and rice with 16%. Fruit and vegetables account for about 12% of global nitrogen consumption, while oilseeds account for 8%.

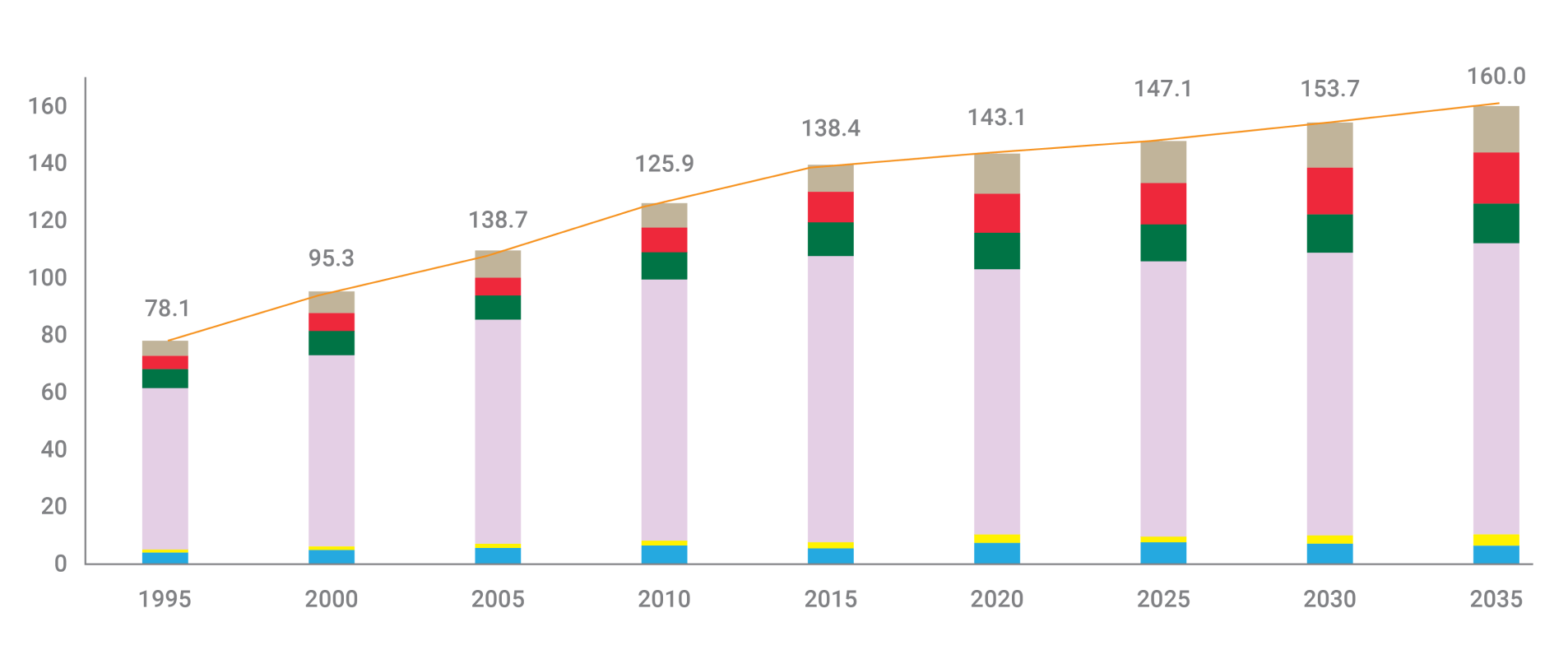

Solid fertilizer urea regional demand outlook (million tonnes)

(Source: Fertecon, January 2023)

Europe

Eurasia

Asia/ Oceania

North America

Latin America

Rest of World

Total

- Asia, Europe, Latin America and North America are still the world’s leading urea consuming markets, which helps producers orient and establish reasonable market access policies to improve their ability to competitiveness in the new context, post-Covid 19.

- Prices of main agricultural products are forecasted to remain high due to the influence of inflation and consumer demand for essential products, thereby helping to improve the demand for fertilizer in general and Urea in particular in 2023, especially in Asia, Latin America and North America.

- Urea production capacity remains high at over 80% worldwide. In addition, the addition of a number of new plants in the period 2020-2022 in India, Nigeria, Brunei, 3 plants in Russia and 10 plants in China will come into operation by the end of 2023, helping urea supply more abundant, this also makes competitive pressure higher in the coming time.

1.2. DAP Market

- Forecast of global DAP demand in 2023 from 72-76 million tons, an increase of 4-7% compared to 2022, due to the forecast of the world’s crop prospects and agricultural area expansion compared to 2022, partly due to a decrease in DAP prices, which further stimulates DAP consumer demand, while the prices of some key agricultural products, especially corn and soybeans, may still remain high due to the influence of the world geopolitical situation.

- In general, demand forecast continues to improve in markets such as Brazil, North America, Asia while consumption in India and China grows more slowly than the rest of the world.

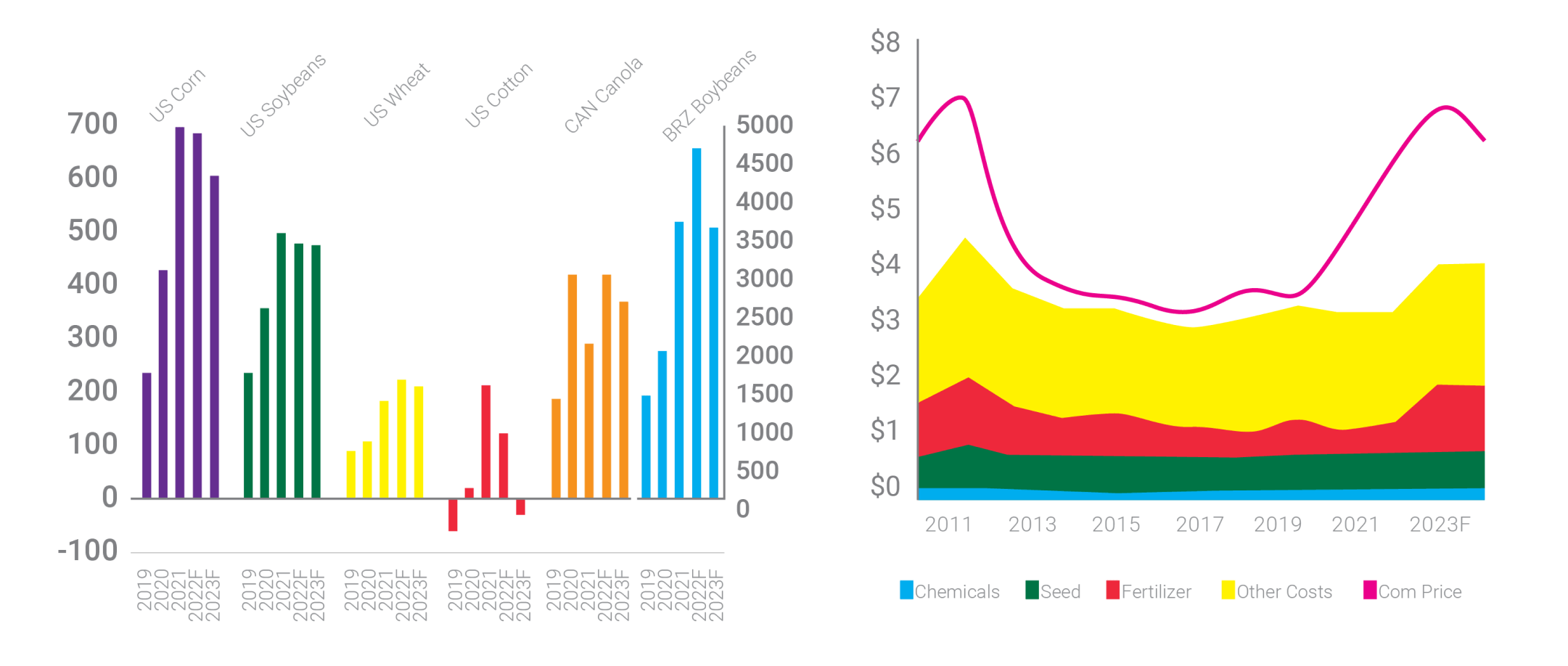

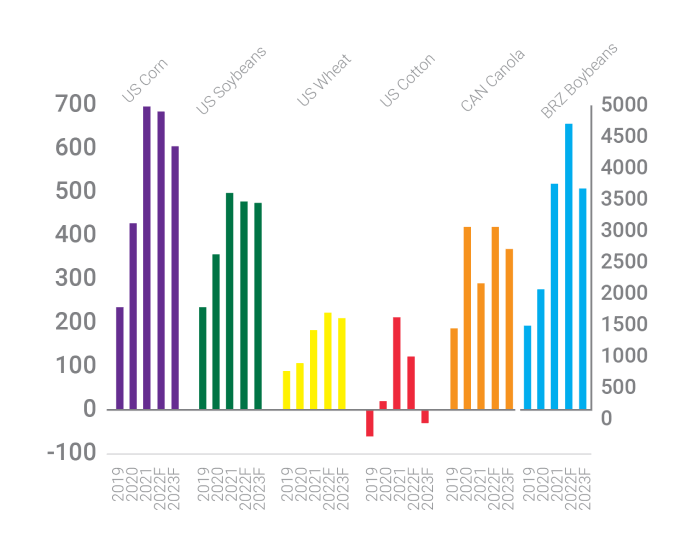

Key Crop Grower Cash Margins

Local Currency Margin/ Acre

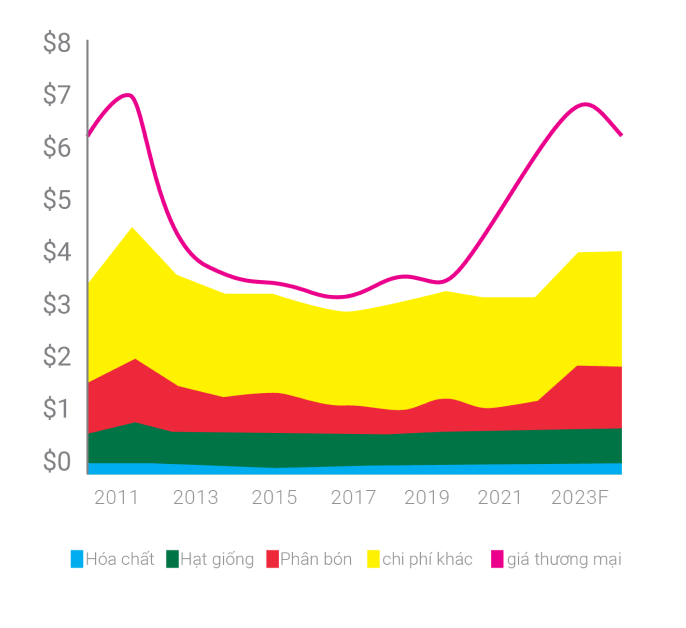

US Corn Cash Selling Price and Costs

US$/bu

(Source: Nuitrient, USA)

- According to forecasts, the prices of major world agricultural products such as corn, soybeans, wheat and cotton in 2023 will remain high compared to recent years. This helps farmers, farms and plantations focus on investing in agriculture as well as psychologically feel secure in the context of the complicated world macroeconomic situation. Especially, the high prices of agricultural products will help increase the affordability of fertilizers, boosting the demand for fertilizers, including DAP, Potassium and Urea.

1.3. Potassium Market

- The global demand for potassium will improve sharply in 2023, estimated at 63-67 million tons, of which the main consumption markets still maintain the growth momentum, notably Latin America (14-15 million tons); China (13.5-14 million tons); North America (8-9 million tons); India (2.4-2.7 million tons); Other Asian countries (8-9 million tons).

- In 2022, the amount of potassium exported from Belarus and Russia, respectively, will decrease by 50%-60% and 20%-25% compared to the previous year due to the impact of US and EU sanctions. This trend is expected to continue, but there may be an improvement when Belarus is currently looking for new export channels through intermediate markets such as China and Russia to improve export output.

- Potassium prices will be heavily influenced by major supply sources such as Canada, Russia, Belarus, the Middle East and China. Currently, major producers are negotiating with India and China on the price range of potash contracts in 2023. However, the official time of these contracts may take place in the first quarter of 2023 to serve as a reference price for world market prices.

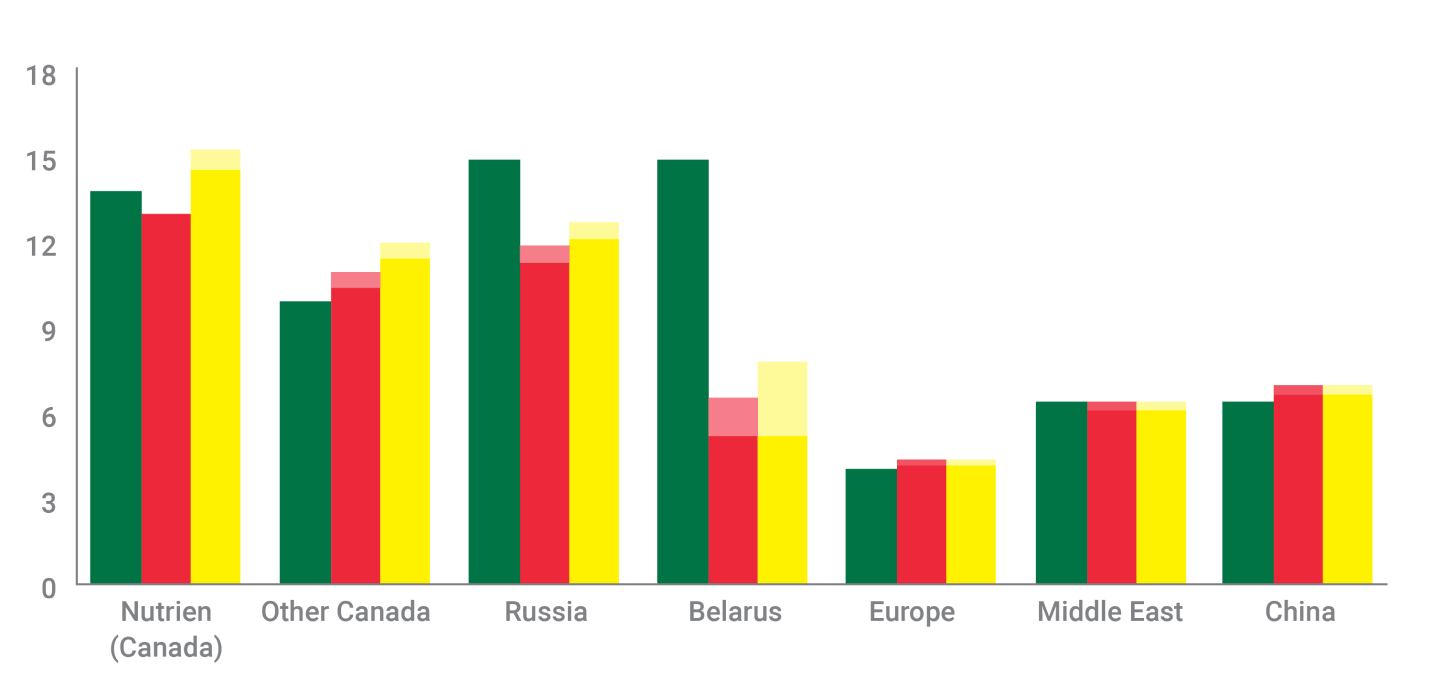

Potash Production in selected Regions

(Source: Nuitrient, USA - January 2023)

2021

2022F Production Range

2023F Production Range

Vietnam market

Fertilizer prices remain high

- Vietnam’s fertilizer consumption demand in 2023 is expected to recover to 9,100 thousand tons thanks to positive weather conditions and an expected increase in rice prices. Rice is the crop that has the greatest impact on Vietnam’s fertilizer demand, so the high price of rice will help farmers increase production and expand the planting area.

Farmers grow jackfruit in Long An

Supply and demand balance of domestic market

No.

Product

Manufacturing capabilities

Symmetrical

01

Urea

4 domestic plants supply 2.2 - 2.5 million tons

In addition to meeting domestic demand, there is still a surplus for export

02

DAP

3 domestic plants meet about 60-75% of demand

The shortfall is covered by imports

03

Potassium

Unable to produce

100% offset by import

04

NPK

About 5 million tons/year

Oversupply but at the same time still need to import high-end NPK line

05

Phosphate fertilizer

1.5 - 2 million tons

Actively respond to domestic demand

06

Other

1.8 - 2.5 million tons

(Source: Collected by PVCFC from sources)